| 1 | EXEMPT STATUS |

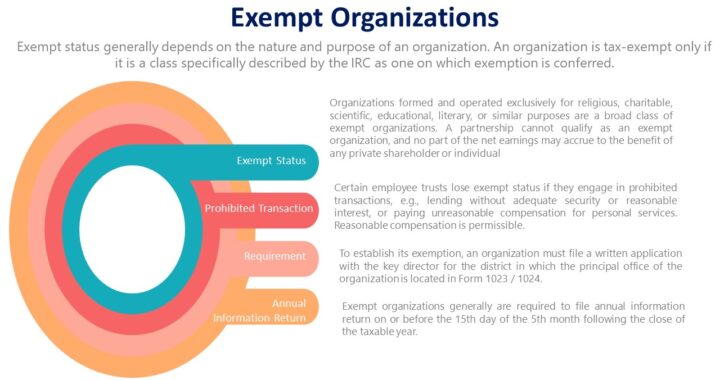

| Exempt status generally depends on the nature and purpose of an organization. An organization is tax-exempt only if it is a class specifically described by the IRC as one on which exemption is conferred. An organization operated for the primary purpose of carrying on a trade or business for profit is generally not tax-exempt. Religious organizations, schools, and animal welfare organizations are all considered exempt because their activities do not involve making a profit. | |

| Among the types of organizations that may qualify as exempt are corporations, trusts, foundations, funds, community funds, etc. A more complete list can be found in Sec. 501(c) along with the permitted stated purposes and requirements. A foundation may qualify for exemption from federal income tax if it is organized for the prevention of cruelty to animals. | |

| Organizations formed and operated exclusively for religious, charitable, scientific, educational, literary, or similar purposes are a broad class of exempt organizations. A partnership cannot qualify as an exempt organization, and no part of the net earnings may accrue to the benefit of any private shareholder or individual | |

| Tax-exempt status is available to various classes of nonprofit organizations under Sec. 501(a). Sec. 501(c)(2) through (25) lists several organizations that may qualify for tax-exempt status, including civic leagues, fraternal benefit societies and labor, agricultural, or horticultural organizations. Blue Cross and Blue Shield organizations are health insurance companies, not qualifying organizations. A privately owned nursing home are not exempt organizations | |

| School qualifies for exempt status under IRC 501(c)(3). No part of net earnings may inure to the benefit of any private shareholder or individual. | |

| The exempt status of an otherwise qualified social club is lost if part of net earnings benefit any private shareholder. Exempt status is also lost if more than 35% of its receipts are from sources other than membership fees, dues, and assessments. Of this 35%, up to 15% may be from the use of the club’s facilities or services by the general public, etc. | |

| No substantial part of activities of an exempt organization may be to influence legislation or a political candidacy; otherwise, it will lose its exempt status. An organization that exceeds the lobbying expenditure limit will be subject to an excise tax of 25% of the excess amount and not loss of exempt status. Direct Participation in a political campaign will cause loss of exempt status, not indirect participation. | |

| 2 | PROHIBITED TRANSACTIONS |

| Certain employee trusts lose exempt status if they engage in prohibited transactions, e.g., lending without adequate security or reasonable interest, or paying unreasonable compensation for personal services. Reasonable compensation is permissible. | |

| 3 | PRIVATE FOUNDATIONS |

| Each domestic or foreign exempt organization is a private foundation unless it receives more than one-third of its support (annually) from its members and the general public, in which case it becomes a public charity. | |

| A private foundation must use Form 990-PF as its annual information return. | |

| A charitable, religious or scientific organization is presumed to be a private foundation unless it either a) is a church with annual gross receipts of under $5,000 or b) Notifies the IRS that is not a private foundation (on Form 1023) must file Form 1023 if the application was filed within 27 months from the end of the month it was organized. | |

| 4 | FEEDER ORGANIZATION |

| An organization must independently qualify for exempt status. It is not enough that all of its profits are paid to exempt organizations. | |

| 5 | REQUIREMENTS FOR EXEMPTION |

| To establish its exemption, an organization must file a written application with the key director for the district in which the principal place of business or principal office of the organization is located. There are specific forms depending on the type of organization applying for the exemption. | |

| Religious, charitable, scientific, educational, etc., organizations (public charities) use Form 1023.Form 1024 is used by most others. If filed with 15 month period, retroactive treatment is available | |

| 6 | ANNUAL INFORMATION RETURN |

| Publication 557 states that annual information returns, employment tax returns, and a report of cash received are all returns that might be required of a tax-exempt organization. | |

| Exempt organizations generally are required to file annual information return on or before the 15th day of the 5th month following the close of the taxable year. | |

| The amount of contribution received is reported and all substantial contributions must be identified. | |

| Those exempted from the requirement are | |

| 1. A church or church-affiliated organization | |

| 2. An exclusively religious activity or religious order | |

| 3. An organization (other than a private foundation) having annual gross receipts that are not more than $50,000 (they must only file an e-postcard) | |

| 4. A stock bonus, pension, or profit-sharing trust that qualified under Sec. 401 | |

| 5. A Keogh plan whose total assets are less than $100,000 | |

| Private Foundations are required to file annual information returns on Form 990 or Form 990-F, regardless of the amounts of gross receipts | |

| Organization with under $50,000 in gross receipts that do not have to file an annual notice will be required to File a Form 990-N. The form must be filed on or before the 15th day of the 5th month following the close of the taxable year. Failure to file the annual report 3 years in a row will subject the organization to loss of its exempt status, requiring the organization to reapply for recognition. | |

| A parent or central exempt organization files a separate return for itself. If it chooses, the organization may also file a group information return for two or more local organizations, as long as none of the local organizations are private foundations. | |

| Form 990-EZ is a shortened version of Form 990. It is designed for use by small exempt organizations and nonexempt charitable trusts. An organization may file Form 990-EZ instead of Form 990 if it meets both of the following requirements: | |

| Gross receipts are less than $200,000, and | |

| Total assets are less than $500,000. |

If you have found this blog to be useful, you may share with your friends. Thanks!