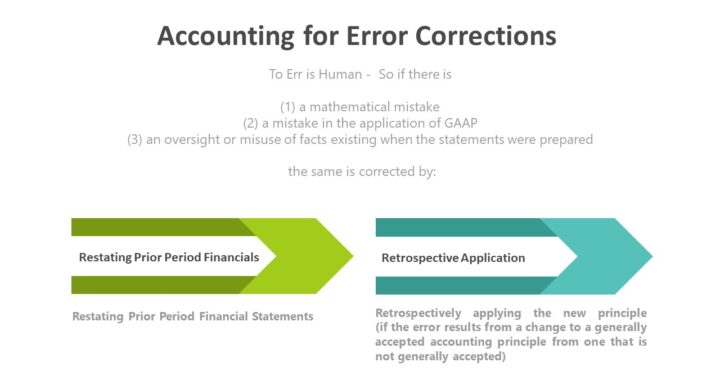

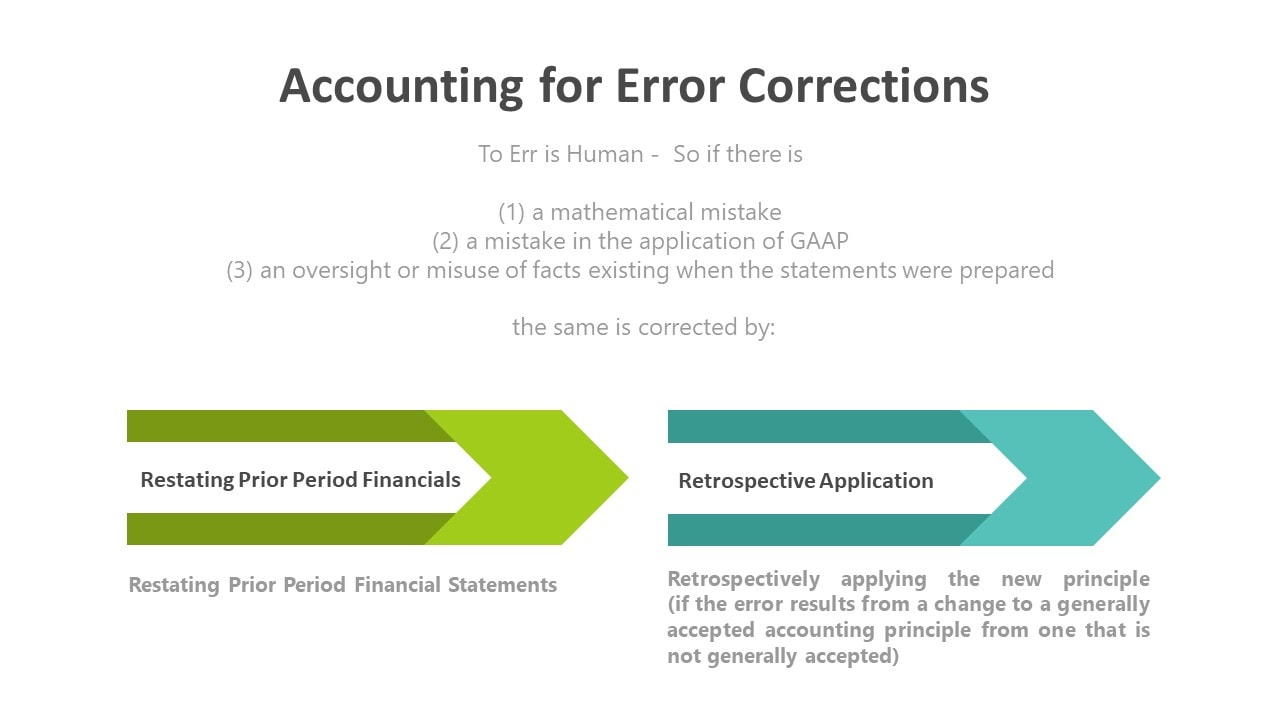

An error in the prior statement results from:

- A mathematical mistake

- A mistake in the application of GAAP; or

- An oversight or misuse of facts existed when the statements were prepared

A change to a generally accepted accounting principle from one that is not an error correction is not an accounting change

An error related to a prior period discovered after the statement is, or is available to be, used must be reported as an error correction by restating the prior period statements. In addition to the revision of the previously issued financial statements, restatement requires the same adjustments as the retrospective application of the new principle.

- The carrying amounts of (1) assets (2) liabilities (3) retained earnings at the beginning of the first period reported are adjusted for the cumulative effect of the error on the prior periods

- Corrections of prior-period errors must not be included in net income

a) When single period statements are presented, prior-period adjustments are made directly to RETAINED EARNINGS (always net of tax)

b) When comparative statements are presented,

(i) RESTATE the prior year's financial statements which are open

(ii) Adjustments pertaining to the closed period(s) should be effected through the opening retained earnings of the earliest open period

Change in Estimate

A change in estimate differs from an error correction because it is based on new information or subsequent developments

Change in Accounting Principle

A change in accounting principle that is NOT generally accepted to one that IS generally accepted is the CORRECTION OF AN ERROR and is treated as PRIOR PERIOD ADJUSTMENT NOT as an accounting principle change.

Error Analysis

Error analysis addresses

- Whether the error affects prior-period statements

- The timing of error detection

- Whether comparative statements are presented

- Whether the error is counterbalancing

An error affecting prior-period statements may or may not affect prior-period net income. An error that affects prior-period net income is counterbalancing if it self-corrects over two periods

Noncounterbalancing error is a misstatement and hence, prior period adjustment will be necessary

If you have found this blog to be useful, you may share with your friends. Thanks!