If a contract includes a variable amount, an entity must estimate the consideration to which it will be entitled in exchange for transferring the promised goods or services to a customer.

The contract price may vary for the following reasons:

- Refunds due to a right of return provided to customers

- Sales Incentives

- Prompt payment discounts

- Volume discounts

- Other uncertainties in contract price based on the occurrence or non-occurrence of some future event

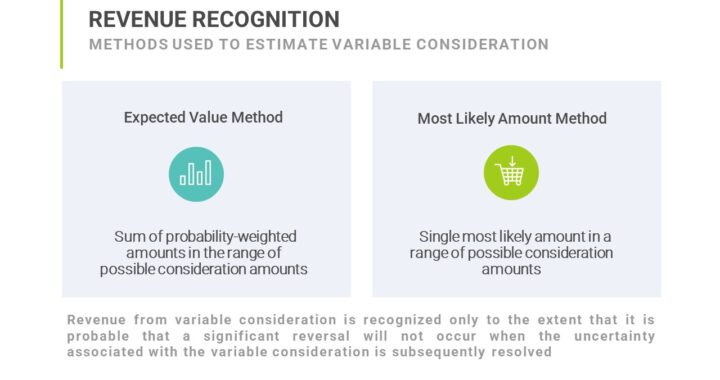

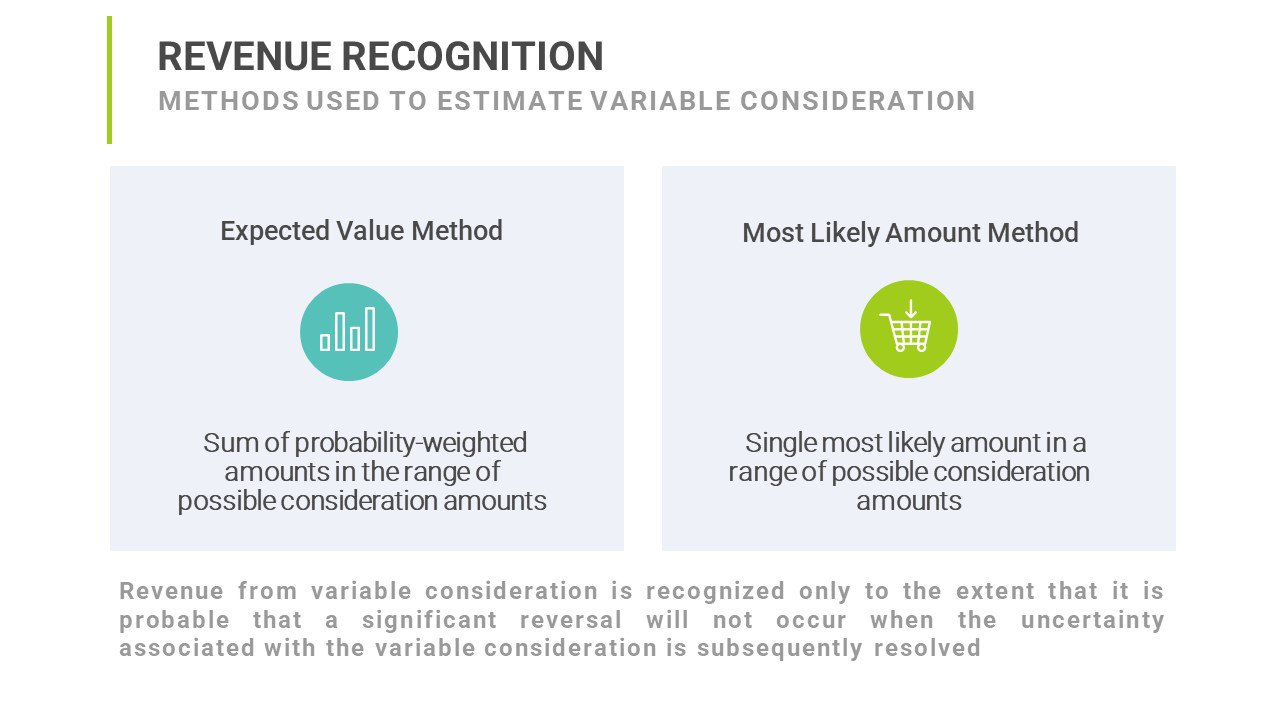

Estimating Variable Consideration

- Expected Value – Sum of probability weighted amounts in the range of possible consideration amounts

- Most Likely Amount

- Single most likely amount in a range of possible consideration amounts

- This may be an appropriate estimate of the amount of variable consideration if the contract has only two possible outcomes

The estimated transaction price must be updated at the end of each reporting period.

Revenue from variable consideration is recognized only to the extent that is probable that a significant reversal will not occur when the uncertainty associated with the variable consideration is subsequently resolved

Volume Discounts

A volume discount offered as an incentive to increase future sales requires the customers to purchase a specified quantity of goods or services to receive a discount

The discount may be applied:

- Prospectively on additional goods or services purchased in the future or

- Retrospectively on all goods or services purchased to-date

A prospective volume discount that provides a material right to the customer is accounted for as a separate performance obligation in the contract

Retrospective volume discounts are accounted for as variable consideration

If you have found this blog to be useful, you may share with your friends. Thanks!