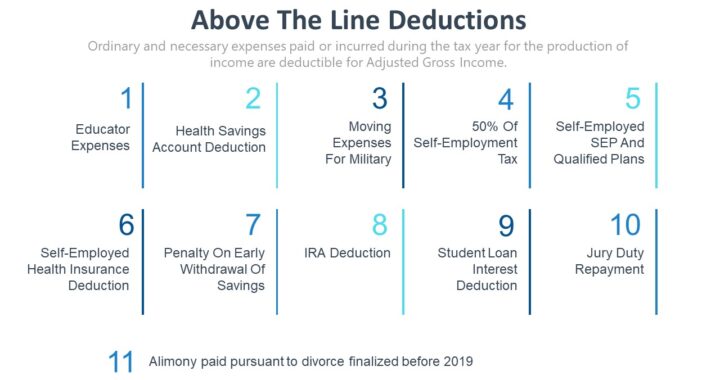

Above the Line Deductions are adjustments deducted from gross income to arrive at adjusted gross income (AGI) for Individual Tax Payers.

Examples of Above the Line Deductions are:

1) Educator expenses

2) Health savings account deduction

3) Moving expenses for military

4) Penalty on early withdrawal of savings

5) Alimony paid pursuant to divorce finalized before 2019

6) Jury duty repayment

7) IRA deduction

8) 50% of self-employment tax

9) Self-employed SEP and qualified plans

10) Self-employed health insurance deduction

11) Student loan interest deduction

If you have found this blog to be useful, you may share with your friends. Thanks!