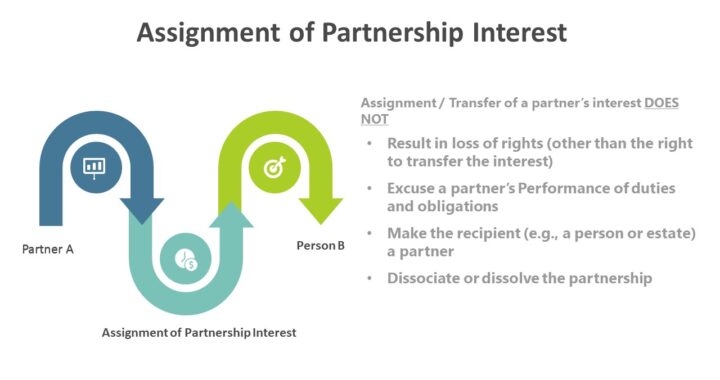

Transfer of a partner’s interest does not

- Result in loss of rights (other than the right to transfer the interest)

- Excuse a partner’s performance of duties and obligations

- Make the recipient (e.g., a person or estate) a partner

- Dissociate or dissolve the partnership

Partnership rights may be assigned without the dissolution of the partnership. The assignee is entitled only to the profits the assignor would normally receive. The assignee does not automatically become a partner and would not have the right to participate in managing the business or to inspect the books and records of the partnership.

A partner’s transferable interest consists of a partner’s share of partnership profits and losses and the right to receive distributions. Partners may sell or otherwise transfer (assign) their interests to the partnership, another partner, or a third party without loss of the rights and duties of a partner (except the interest transferred). Moreover, unless all the other partners agree to accept the assignee as a new partner, the assignee does not become a partner in the firm. Without partnership status, the assignee has no obligation for partnership debts.

A partner may assign his or her interest in the partnership but is not allowed to assign rights in specific partnership property. A partner’s individual creditors may not attach partnership property but may charge a partner’s interest in the partnership. Only a claim against the entire partnership allows specific partnership property to be attached.

The assignment transfers the assignor’s interest in partnership profits and losses and the right to distributions.

If you have found this blog to be useful, you may share with your friends. Thanks!