Documentation of Audit Plans include:

The overall audit strategy (basis of the audit plan)

Procedures to be performed

Risk assessment procedures

Further procedures

Other procedures

Involvement of specialists

Three aspects of audit procedures should be documented in audit plans are:

NET of procedures

N = Nature

E = Extent

T = Timing

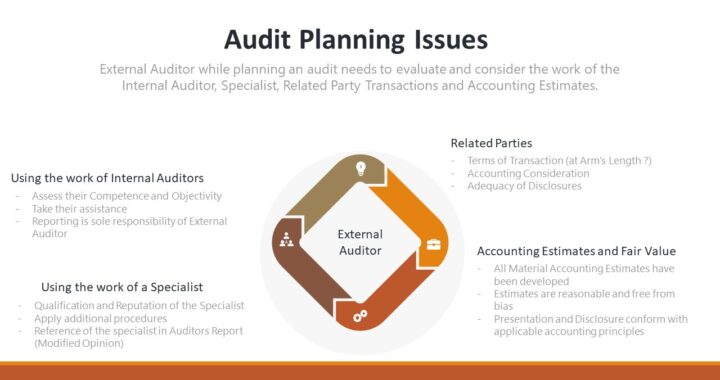

Factors external auditors consider before using the work of internal auditors are:

The objectivity of the internal auditors

The level of competence of the internal audit function

Whether the internal audit function applies a systematic and disciplined approach

Factors auditors consider before using the work of a specialist are:

The auditor should evaluate whether the auditor’s or management’s specialist has the necessary

Competence,

Capabilities, and

Objectivity.

Transactions that may suggest related-party transactions are:

Exchanging property for similar property in a nonmonetary transaction

Borrowing or lending at rates significantly above or below market rates

Selling realty at a price materially different from its appraised value

Making loans with no scheduled repayment terms

Accounting estimates

The objective of the auditor is to obtain sufficient appropriate audit evidence about whether accounting estimates, including fair value accounting estimates, are reasonable and related disclosures are adequate. This is achieved by determining whether

Management has appropriately applied the applicable financial reporting framework

The methods for making the accounting estimates are appropriate and have been applied consistently

The estimates, individually or collectively, exhibit no significant management bias

If you have found this blog to be useful, you may share with your friends. Thanks!