Electronic Data Interchange

Electronic Data Interchange – EDI is the communication of electronic documents directly from a computer in one entity to a computer in another entity. The advantages of using EDI are: Reduced clerical errors Increased speed Elimination of repetitive clerical tasks Elimination of document preparation, processing, filing, and mailing costs An audit trail allows for the […]

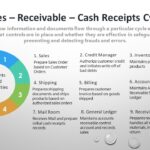

Continue reading→Sales – Receivables – Cash Receipts Cycle

Completeness assertion for sales and receivables Reconciling total amounts in subsidiary ledgers with the general ledger Performing analytical procedures (e.g., comparing accounts receivable turnover with previous year) Accounting for the numerical sequence of sales orders, shipping documents, and invoices Tracing from sales invoices to shipping documents Accuracy assertion for sales and receivables Obtaining management representation […]

Continue reading→IT Controls – General and Application Controls

Types of Controls and Scope General controls – The organization’s entire processing environment Application controls – Particular to each of the organization’s applications Three Categories of Application Controls are: Input controls Processing controls Output controls Three types of controls classified by function are: Preventive controls Detective controls Corrective controls Input controls provide reasonable assurance that […]

Continue reading→Components of Internal Control

Three Objectives of Internal Control are: Operations —- Effectiveness and efficiency of operations Reporting — Reliability of financial reporting Compliance — Compliance with applicable laws and regulations 5 Components of Internal Control are: Internal controls stop CRIME Control activities Policies and procedures Risk assessment process Identification and analysis of relevant risks Information system Information systems […]

Continue reading→Audit – Strategic Planning Issues

Documentation of Audit Plans include: The overall audit strategy (basis of the audit plan) Procedures to be performed Risk assessment procedures Further procedures Other procedures Involvement of specialists Three aspects of audit procedures should be documented in audit plans are: NET of procedures N = Nature E = Extent T = Timing Factors external auditors […]

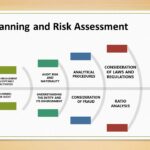

Continue reading→Audit Planning and Risk Assessment

[A] Pre-Engagement Acceptance Responsibilities 1) Preconditions for an Audit – Auditor to determine that management uses Acceptable financial reporting framework Understands its responsibility for the preparation and fair presentation of financial statements Understands its responsibility for the design, implementation and maintenance of internal control and Understands its responsibility to provide access to all information 2) […]

Continue reading→Professional Responsibilities

AICPA Code of Professional Conduct has a set of specific mandatory rules describing minimum levels of conduct a member must maintain as a CPA Profession has a responsibility to the public. AICPA Code of Professional Conduct expects the CPA to honour public trust Rules that are mandatory for all members are : (a) Integrity and […]

Continue reading→Engagement Responsibilities

Audit Engagements Purpose of Audit is to provide users of financial with an opinion on whether the financial statements are presented fairly, in all material respects in accordance with the applicable financial reporting framework Objective of Audit is to (1) Obtain reasonable assurance (2) Express an Opinion (3) Report findings as required by GAAS (4) Be Independent and comply with relevant ethical rules Auditor to (1) Exercise professional judgement (2) With Professional Skepticism (3) Recognize that circumstances may […]

Continue reading→Covid 19 – Statutory & Regulatory Compliances

Following are several important relief measures taken by the Government of India in view of COVID-19 outbreak, especially on statutory and regulatory compliance matters related to several sectors:— A. INCOME TAX [1] Income Tax Extend last date for income tax returns for (FY 18-19) from 31st March, 2020 to 30th June, 2020. [2] Aadhaar-PAN linking […]

Continue reading→Corporate Social Responsibility (CSR) – Activities, Reporting & Accounting

CSR CONCEPTS Corporate Responsibility is the continuing commitment by business to behave ethically and a positive continuity towards social and economic development at large. It is the contribution of the corporate sector for philanthropic causes like education, health, water, environment and community welfare. Corporate responsibility evokes from good governance. Good Governance covers moral values, powers, […]

Continue reading→