A bond is a formal contractual agreement by an issuer to pay an amount of money (face amount) at the maturity date plus interest at the stated rate at specific intervals. All items are stated in a document called an indenture

The investor in a bond may elect FVO since the bond is a financial asset. Absent this election, a bond is classified as trading, held-to-maturity or available for sale security

Purchase Price

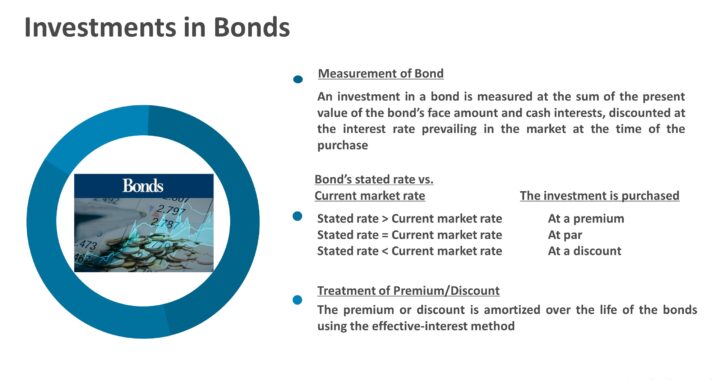

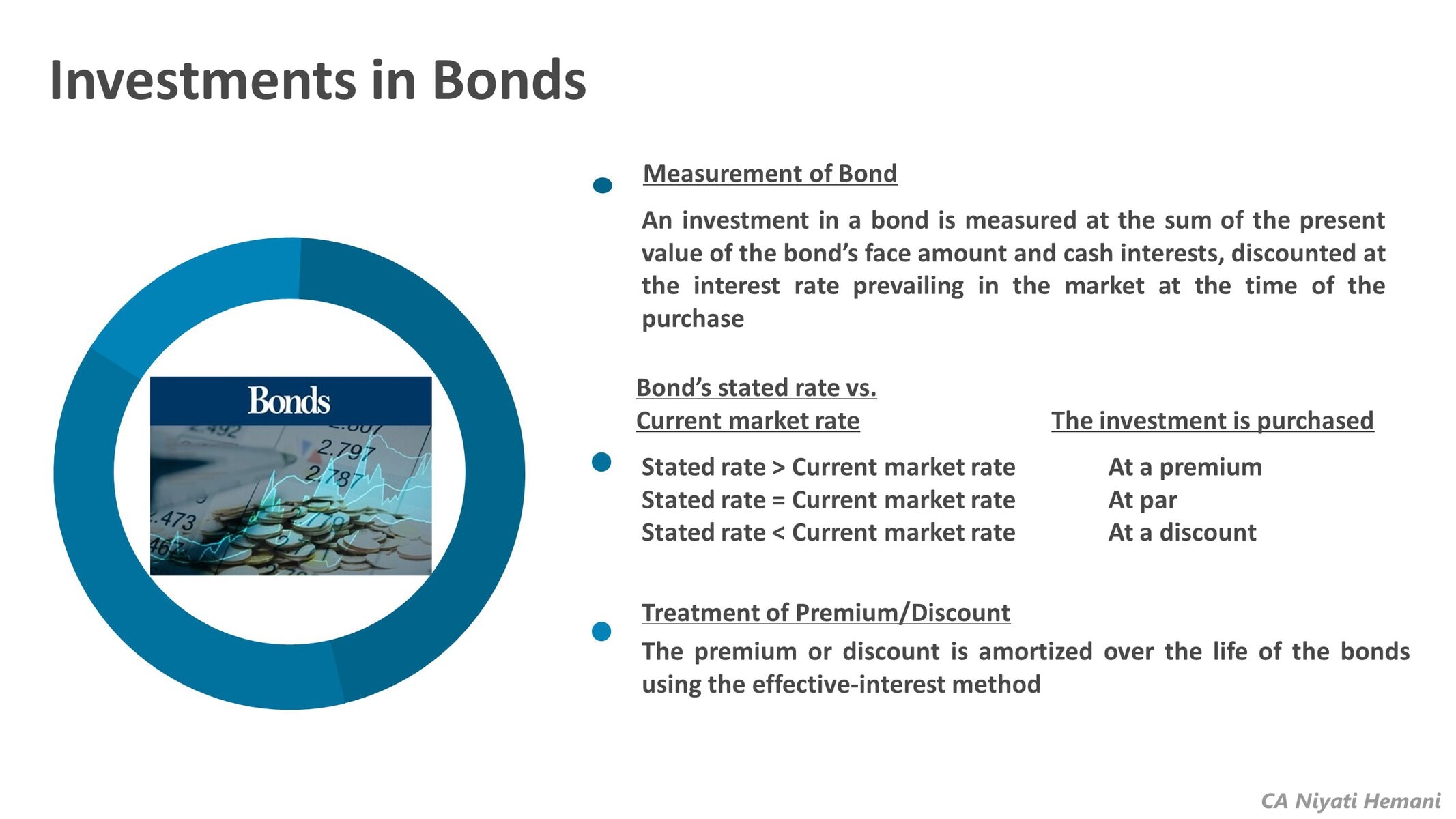

An investment in a bond is recorded on the purchaser's books at the present value of the bond's two cash flows:

- The face amount (maturity amount) receivable on the bond's maturity date, and

- The annual cash interest (i.e. face amount * stated interest rate)

If the bond's stated rate differs from the market rate at the time of the purchase, the price paid will not equal the face amount

a. If the bond's stated rate is greater than the current market rate, the purchase price is higher than the face amount and the bond is purchased at a premium

b. If the bond's state rate is less than the current market rate, the purchase price is lower than the face amount and the bond is purchased at a discount

An investor in bonds does not use a separate premium or discount account. The investor records the investment at historical cost

Purchase between interest payment dates

If the bonds are purchased between interest payment dates, cash paid to the seller includes interest accrued

Accrued interest on the date of purchase since the last payment date should be debited to interest receivable and the balance should be debited to bonds account

Amortizing a Premium or Discount

Held-to-maturity securities (bonds) are recorded at their historical cost (including brokerage fees but excluding accrued interest at purchase)

Any discount or premium (i.e the difference between the purchase price and maturity amount) is amortized over the remaining life of the debt using the effective interest method

Amortization results in the carrying amount of the asset adjusted over time, reaching the face amount at maturity

The straight-line method is used only if its results are not materially different from those of the effective-interest method

Effective Interest Method

Interest method results in a constant rate of return on a receivable

Interest Revenue = Net Book Value * Effective Rate of Interest

The amount of discount or premium amortized is the difference between interest revenue and the actual amount of cash received based on the contract rate of interest

Discount/Premium Amortized = Interest Revenue (NetBook Value*Effective Rate) - Actual amount received at a stated interest

Net Book Value (Carrying Value) of Bond:

- INCREASES as and when the DISCOUNT is amortized

- DECREASES as and when the PREMIUM is amortized

As the carrying value increases or decreases from period to period, the amount of amortization also increases or decreases from period to period

Carrying Amount = Face Value + Unamortized Premium (-) Unamortized Discount

Detachable Warrants

When debt securities with detachable warrants are purchased, the purchase consideration paid should be allocated between the warrants and the securities based upon their relative fair values at issuance

If you have found this blog to be useful, you may share with your friends. Thanks!