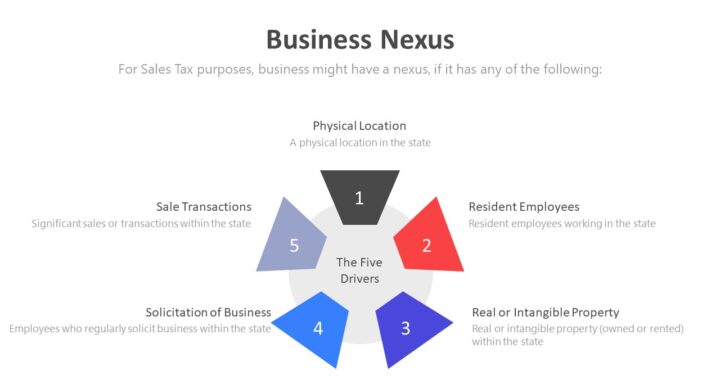

For a taxing authorities to tax sales and income-generating activities, nexus is required to be established of a physical and/or financial presence within a jurisdiction. Here are the 5 drivers in establishing the nexus …

|

For a taxing authorities to tax sales and income-generating activities, nexus is required to be established of a physical and/or financial presence within a jurisdiction. Here are the 5 drivers in establishing the nexus …

|