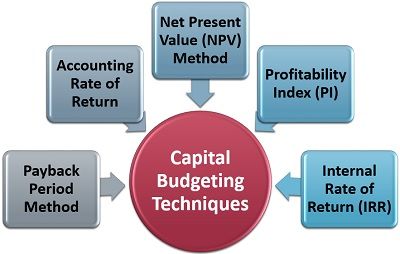

Capital Budgeting

Capital budgeting is the process of planning and controlling investments for long-term projects.

Many capital budgeting techniques used for screening and preference decisions require the identification of the relevant cash flows for the project.

The accounting rate of return is a technique used to assess potential capital projects that ignores the time value of money.

Accounting rate of return = Annual increase in GAAP net income / Required Investment

Accounting rate of return = (Annual cash inflow – depreciation) / Initial Investment

Net Present Value

Discounted cash flow analysis discounts the relevant cash flows to present value using the required rate of return as the discount rate.

The discount rate may also be referred to as the hurdle rate and is defined as the minimum acceptable rate when choosing to invest in a project. This rate must be adjusted for inflation and project-specific risks.

A capital project’s NPV is the present value of all benefits minus the present value of all costs.

If the NPV is positive, the project should be accepted. If it is negative, the project should be rejected.

Discounted cash flow analysis can be useful in making a decision whether to lease or purchase an asset.

The NPV method provides a better understanding of the problem in many decision situations because reinvestment is assumed to be at the required rate of return.

Internal Rate of Return

IRR is the discount rate at which the Investment’s NPV equals zero.

If the IRR is higher than the company’s hurdle rate, the investment should be accepted. If it is lower, the investment should be rejected.

Firms with higher hurdle rates prefer quick profits, whereas firms with lower hurdle rates prefer a steady payback.

IRR method assumes reinvestment is at the IRR. If the project’s funds are not reinvested at the IRR, the ranking calculations obtained may be in error.

Comparison of NPV and IRR Method

The NPV and IRR methods give the same accept or reject decisions if the projects are independent. However, if the projects are mutually exclusive, the NPV and IRR method may rank differently if:

- The cost of one project is greater than the cost of another

- The timing, amounts, and directions of cash flows differ among projects

- The projects have different useful lives

- The cost of capital or desired rate of return varies over the life of a project

- Multiple investments are involved in a project

Payback Methods

The payback period is the number of years required for the net cash savings or inflows to equal the original investment. It measures the risk and liquidity of an investment. The longer the period, the higher the risk and the lower the liquidity.

Payback Period = Initial Investment / Annual after-tax savings (Cash inflow)

The discounted payback period takes into account the time value of money.

Breakeven time is the time required for the discounted cash flows of an investment to equal its initial cost.

Profitability Index

Under capital rationing, management determines which investments provide the highest return per dollar invested.

The profitability index is a method for ranking projects to ensure that limited resources are placed with the investments that will generate the highest return per dollar invested.

Profitability Index = PV of future net cash flows or NPV of project/Initial Investment

If you have found this blog to be useful, you may share with your friends. Thanks!