Core Capital Structure

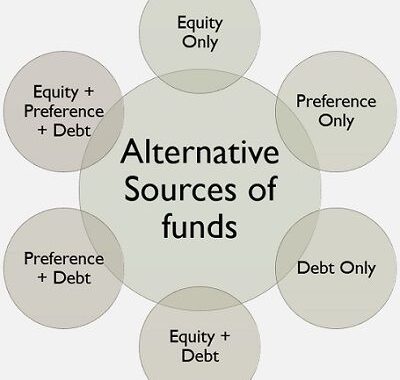

Corporate Capital Structure may be financed by bonds, equity, and preference share capital.

Bonds

Bonds are the main form of long-term debt financing. It is a formal contract to pay an amount of money to the holder at a certain date. Most bonds provide for a series of cash interest payments on a specified percentage of the face amount at specified intervals.

Bond Valuation

Bond price equals the present value of the principal at maturity and periodic interest discounted at the market (effective) interest rate.

Operating Leverage

Operating leverage is the extent to which a firm’s cost of operating is fixed as opposed to variable. A firm’s degree of operating leverage (DOL) A firm’s degree of operating leverage (DOL) measures the effect that given fixed operating costs have on earnings.

DOL = % change in earnings before interest and taxes / % change in sales

Financial Leverage

Financial Leverage is the degree of debt in a firm’s financial structure. A firm’s degree of financial leverage measures the effect that an amount of fixed financing costs has on earnings per share.

EPS = Net Income available to common shareholders / Weighted-average common shares outstanding

DFL = % change in EPS / % change in EBIT

The degree of total (combined) leverage (DTL) is the product of DOL and DFL

When you are evaluating a debt option for capital structure, check out the degree of financial leverage for the additional debt

Equity

Common shareholders are the owners of the corporation, not guaranteed a return, and last in priority in liquidation. Shareholders’ capital provides the cushion for creditors if any losses occur on liquidation.

Common stock valuation is based on dividend payout models.

P0 = [D1 / 1+r)^1] + [D2/(1+r)^2] + [D3/(1+r)^3 …..+ Dt/(1+r)^t]

r = required rate of return

Assuming dividends are constant and paid continuously, the price per share is calculated as follows:

P0 = D / r

Assuming dividends and price increase at the same constant rate, the price per share is calculated as follows:

P0 = D0 (1+g)/(r-g) = D1/(r-g)

When opting for equity, figure out the share price based on dividends and the growth rate

Preferred Stock

Preferred stock is a hybrid of debt and equity. It has a fixed charge and increases leverage, but the payment of dividends is not an obligation. Preferred shareholders stand ahead of common shareholders in priority in the event of corporate bankruptcy.

Preferred stock valuation applies the same method used to value a perpetual bond:

Preferred stock price (Pp) = Dp / r

Dp = Par value of preferred stock * Preferred dividend rate

Other market-based measures of shareholder wealth include the dividend payout ratio, dividend yield ratio, and shareholder return.

Dividend payout ratio = Dividend paid per share / Earnings per share = Cash dividend / Net Income

Dividend Yield = Dividend per share / Market price per share

Shareholder return =

Ending stock price – Beginning stock price + Annual dividend per share / Beginning stock price

Capital structure and solvency

A firm’s capital structure includes its sources of financing, both long and short term.

Solvency is the firm’s ability to pay its non-current obligations as they come due and thus remain in business in the long run, which can be measured by the times interest earned ratio.

Times Interest Earned Ratio = Earnings before Interest and Taxes / Interest Expense

Capital Structure Ratios report the relative proportions of debt and equity in a firm’s capital structure. These ratios include the following:

Total debt ratio = Total debt / Total assets

Total debt to total capital = Total debt / Total capital

Debt to equity = Total debt / Shareholder’s equity

Long-term debt to equity = Long-term debt / Shareholder’s equity

Component Costs of Capital

- Long-term debt = Effective rate * (1 – Marginal tax rate)

- Preferred stock = Cash dividend / Market price of preferred stock – Flotation costs

- Retained earnings = Next dividend per share / Share price + Dividend growth rate

Evaluate the various capital structures with their relative costs and make the right mix

The component cost of common stock can also be calculated using the CAPM

R common equity = Rf + B(Rm – Rf)

Weighted-Average Cost of Capital

A firm’s weighted-average cost of capital (WACC) is a single, composite rate of return on its combined components of capital. The weights are based on the firm’s target capital structure.

WACC = D/V * Rd*(1-T) + E/V*Re + P/V*Rp

If you have found this blog to be useful, you may share with your friends. Thanks!