You would agree that “Effective corporate governance relies heavily on effective systems of (1) Internal control and (2) Enterprise risk management.” The Committee of Sponsoring Organizations of the Treadway Commission (COSO) has established a widely accepted framework for each system. The COSO framework consists primarily of: A definition of internal control Categories of objectives […]

Continue readingCategory Archives: Business & Finance

The Sarbanes-Oxley Act, 2002 and Audit Committee

The Sarbanes-Oxley Act of 2002 (SOX) was spurred by past major accounting scandals that resulted in the loss of investor confidence. SOX, therefore, aims to protect investors by making corporate disclosures more accurate and reliable. Role of Audit Committee Thus, the role of the audit committee becomes essential in the effective execution of the SOX. One […]

Continue readingBusiness Model, Processes, KPI and Risk Management

Business Model Whether it be to earn money or a charitable goal, we need to have a business model. A business model consists of the business objectives (eg. vision, mission, and high-level strategies) and how the business processes achieve these objectives. Two main approaches to understanding the business model are:a) Top-Down Approach – It begins […]

Continue readingData Analytics – Uses

In an age of Internet of Things and Big Data, Data Analytics is becoming increasingly important. Data Analytics involves qualitative and quantitative methodologies and procedures to retrieve data out of data sources and then inspect the data based on data type to facilitate decision making. Bigdata is only as valuable as the business outcomes […]

Continue readingAuditing Through The Computer

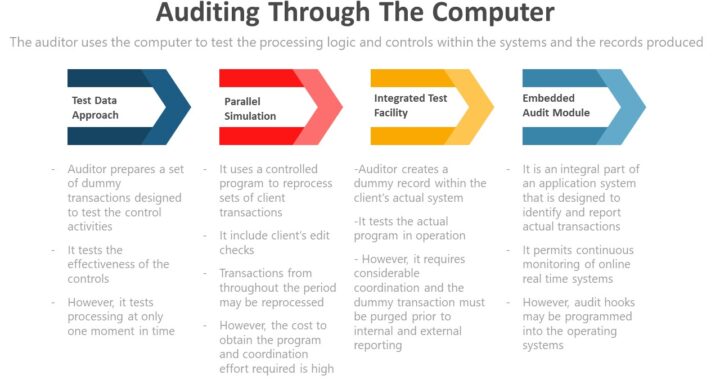

Auditing through the computer – Uses the computer to test the processing logic and controls within the system and the records produced

Test Data Approach – In the test data approach, the auditor prepares a set of dummy transactions specifically designed to test control activities that management claims to have incorporated into the processing programs.

Parallel Simulation – A parallel simulation uses a controlled program (auditor developed program) to reprocess sets of client transactions (real transactions and not dummy) and compares the auditor-achieved results with those of the client.

Integrated Test Facility – Using the integrated test facility (ITF) method, the auditor creates a dummy record within the client’s actual system (e.g., a fictitious employee in the personnel and payroll file). Dummy and actual transactions are processed.

Embedded Audit Module – An embedded audit module is an integral part of an application system that is designed to identify and report actual transactions and other information that meets the criteria of having audit significance (e.g., transactions over $5,000).

If you have found this blog to be useful, you may share with your friends. Thanks!

Purchases-Payables-Cash Disbursement Cycle

Testing of Completeness Assertion for Accounts Payable and Purchases Reconciling total amounts in subsidiary ledgers with the general ledger Performing analytical procedures (e.g., comparing accounts payable turnover with the previous year) Tracing subsequent payments to recorded payables Searching for unvouchered (unsupported) payables Testing of Accuracy Assertion for Accounts Payable and Purchases Obtaining management representation letters […]

Continue readingPayroll Responsibilities

Duty Department/Individual Provides authorizations of employees and their pay rates – Human resources Oversees employees’ working hours (time cards) – Timekeeping Prepares the payroll register – Payroll Prepares payment vouchers – Accounts payable Approves the payments (signing checks) – Cash disbursement (CFO) Records the payrolls – General ledger If you have found this blog to […]

Continue readingElectronic Data Interchange

Electronic Data Interchange – EDI is the communication of electronic documents directly from a computer in one entity to a computer in another entity. The advantages of using EDI are: Reduced clerical errors Increased speed Elimination of repetitive clerical tasks Elimination of document preparation, processing, filing, and mailing costs An audit trail allows for the […]

Continue readingSales – Receivables – Cash Receipts Cycle

Completeness assertion for sales and receivables Reconciling total amounts in subsidiary ledgers with the general ledger Performing analytical procedures (e.g., comparing accounts receivable turnover with previous year) Accounting for the numerical sequence of sales orders, shipping documents, and invoices Tracing from sales invoices to shipping documents Accuracy assertion for sales and receivables Obtaining management representation […]

Continue readingIT Controls – General and Application Controls

Types of Controls and Scope General controls – The organization’s entire processing environment Application controls – Particular to each of the organization’s applications Three Categories of Application Controls are: Input controls Processing controls Output controls Three types of controls classified by function are: Preventive controls Detective controls Corrective controls Input controls provide reasonable assurance that […]

Continue reading