Section 121 provided an exclusion upon the sale of a principal residence. No loss may be recognized on the sale of a principal residence. Two tests to qualify for exclusion of gain upon principal residence are: Ownership test – Taxpayer has owned the residence for 2 of the 5 prior years Use test – Taxpayer […]

Continue readingCategory Archives: Us Income Tax

Like Kind Exchanges

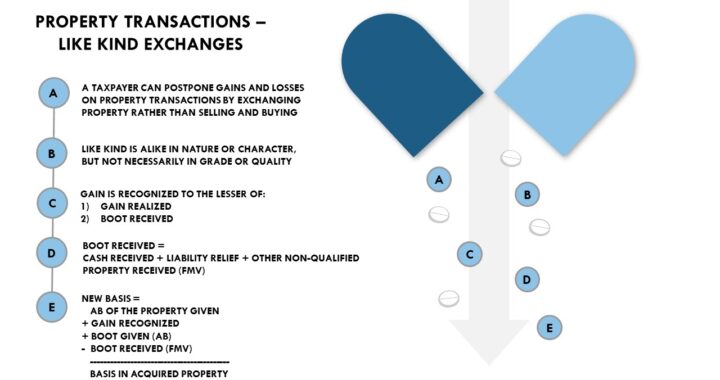

Section 1031 defers recognizing gain or loss to the extent that real property productively used in trade or business or held for production of income (investment) is exchanged for property of like kind. Only real property qualifies for like kind exchange.

Like-kind refers to the nature or character of the property. Real estate for real estate qualifies as a like-kind exchange even if the properties are as different as a rental office building and a parking lot, or even if the properties are located in different states. All other property, including stocks (and other securities and debt instruments) and partnership interests, is excluded from qualifying for like-kind exchange treatment.

Boot is all nonqualified property transferred in an exchange transaction. Boot received includes cash, net liability relief, and other nonqualified property (its FMV).

Recognized Gain = Lesser of gain realized or boot received

Deferred gain = Realized gain – Recognized gain

Deferred loss = Realized loss

Basis of acquired property = AB of property given + Gain recognized+ Boot given – Boot received

OR

Basis of acquired property = FMV of acquired property – Deferred gain + Deferred loss

Related Party Sales

Limited Tax Avoidance Rules limit tax avoidance between related parties. Gain recognized on an asset transfer to a related person in whose hands the asset is depreciable is ordinary income. Loss realized on the sale or exchange of property to a related person is not deductible. Under Sec. 267, losses are not allowed on sales […]

Continue readingSmart Business Stock Exclusion

Stock qualifies as Section 1202 stock if it is received after August 10, 1993, the corporation is a domestic C corporation, the seller is the original owner of the stock, and the corporation’s gross assets do not exceed $50 million at the time the stock was issued. Additional requirements do exist. However, the total gross assets […]

Continue readingSelf Employed Business Income and Expenses

Self Employed Business Income and Expenses Self Employment Income is generally reported by Sole proprietors and Independent contractors The three requirements for an expense from a trade or business to be deductible from self-employment income are Ordinary, Necessary, and Reasonable Business Expenses may include: Rent Business Meals Travel Foreign Travel Entertainment Automobile Expenses Taxes Insurance […]

Continue readingEmployee Benefits

Employee Benefits Include the below: Fringe Benefits Employee Discounts De Minimis Qualified Transportation Fringe Benefits Employer-Provided Educational Assistance Employer-Provided Life Insurance Accident and Health Plans Death Benefits Meals and Lodging Incentive Stock Options Cafeteria Plans If you have found this blog to be useful, you may share with your friends. Thanks!

Continue readingAbove The Line Deductions

Above the Line Deductions are adjustments deducted from gross income to arrive at adjusted gross income (AGI) for Individual Tax Payers. Examples of Above the Line Deductions are: 1) Educator expenses 2) Health savings account deduction 3) Moving expenses for military 4) Penalty on early withdrawal of savings 5) Alimony paid pursuant to divorce finalized […]

Continue readingQualified Business Income Deduction

The QBID is available to non-corporate taxpayers, including Individuals, Trusts, and Estates. The Sec. 199A deduction is available to non-corporate taxpayers who have qualified business income, which requires the income to be from qualified pass-through entities. Qualified pass-through entities include sole proprietorships, S corporations, partnerships, trusts, and estates. Qualifying business income 1) Is effectively connected […]

Continue readingStandard and Itemized Deductions

Taxable Income = AGI – Itemized Deduction on Schedule A or the standard deduction – QBID Standard Deductions Persons who are not allowed Standard Deductions are: 1) Persons who itemize deductions 2) Nonresident alien individuals 3) Individuals who file a “short period” return 4) Married individuals who file a separate return and whose spouse itemizes […]

Continue readingTax Authority

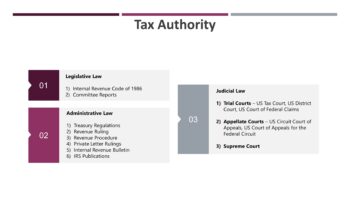

3 Sources of Authoritative Federal Tax Law are: Legislative law Administrative law Judicial law Legislative Law Legislative law, which comes from Congress is authorized by the constitution and consists of the Internal Revenue Code and Committee Reports. The Internal Revenue Code of 1986 is the primary source of Federal Tax Law. It imposes income, estate, […]

Continue reading