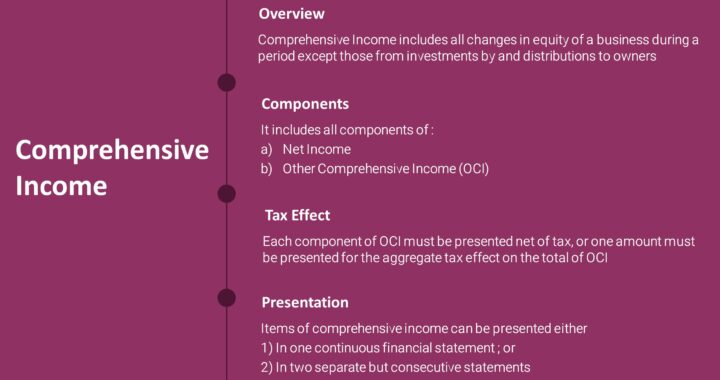

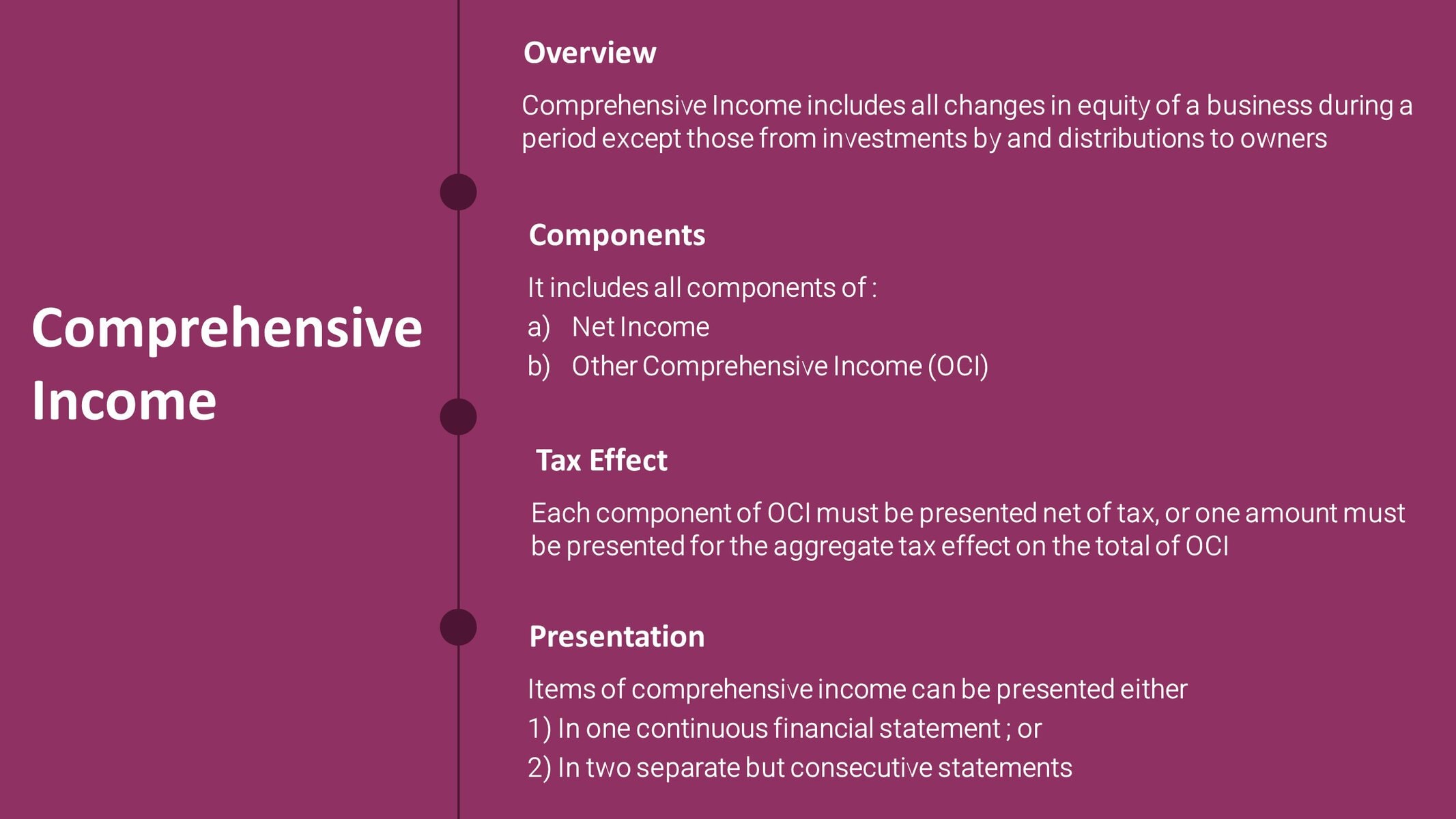

Comprehensive income includes all changes in equity of a business during a period except those from investments by and distributions to owners

It includes all components of Net Income and Other Comprehensive Income (OCI)

Comprehensive Income = Net Income + Other Comprehensive Income

Other comprehensive income (OCI) items are:

- Foreign Currency Translation Adjustments

- Unrealized Gains on Available-For Sale securities

- Unamortized Items from Retirement Benefit Obligation

- The effective portion of Cash Flow Hedge

Reporting

An entity that presents a full set of financial statements but has no items in the OCI need not report OCI or comprehensive income

FASB requires all non-owner changes in stockholder’s equity to be presented either:

- In a single continuous statement of comprehensive income; or

- In two separate but consecutive statements

Single continuous statement

In a single continuous statement, the entity is required to present the components of net income and total net income, the components of other comprehensive income, and a total for other comprehensive income, along with the total of comprehensive income in that statement

Two separate but consecutive statements

In the two-statement approach, the first statement (income statement) presents the components of net income and total net income

The second statement (statement of OCI) is presented immediately after the first and must include the components of other comprehensive income and a total for other comprehensive income, along with a total for comprehensive income

The second statement begins with net income

Each component of OCI is displayed ALWAYS net of tax

The total of OCI for a period must be transferred to a component of equity (a permanent account or a real account) separate from retained earnings and additional paid-in capital

The component must have a descriptive title eg. Accumulated OCI

The changes in the accumulated balances for each component of OCI must be disclosed on the face of the statements or the notes

Reclassification adjustments must be made for each component of OCI

If you have found this blog to be useful, you may share with your friends. Thanks!