Derivatives

A call (put) option is the right to purchase (sell) an asset at a fixed price (i.e., the exercise price or the strike price) on or before a future date (i.e., expiration date).

A forward contract is an agreement for the purchase and sale of a stated amount of a commodity, foreign currency, or financial instrument at a stated price.

The accounting for derivatives and hedging is based on certain principles:

- Derivatives should be recognized as assets or liabilities depending on the contract’s terms,

- Fair value is the only relevant measure of derivatives, and

- Designated hedged items should receive special accounting treatment only if they meet qualifying criteria.

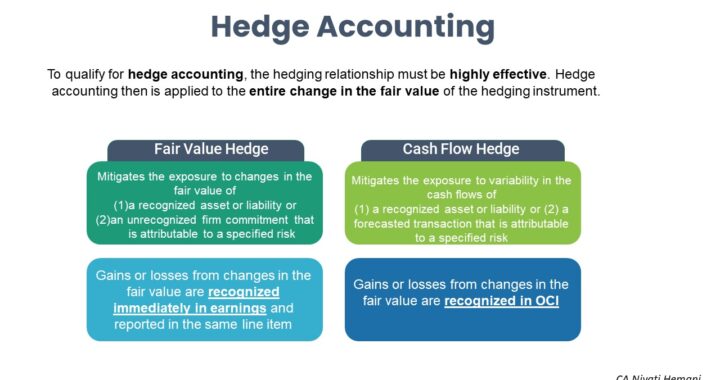

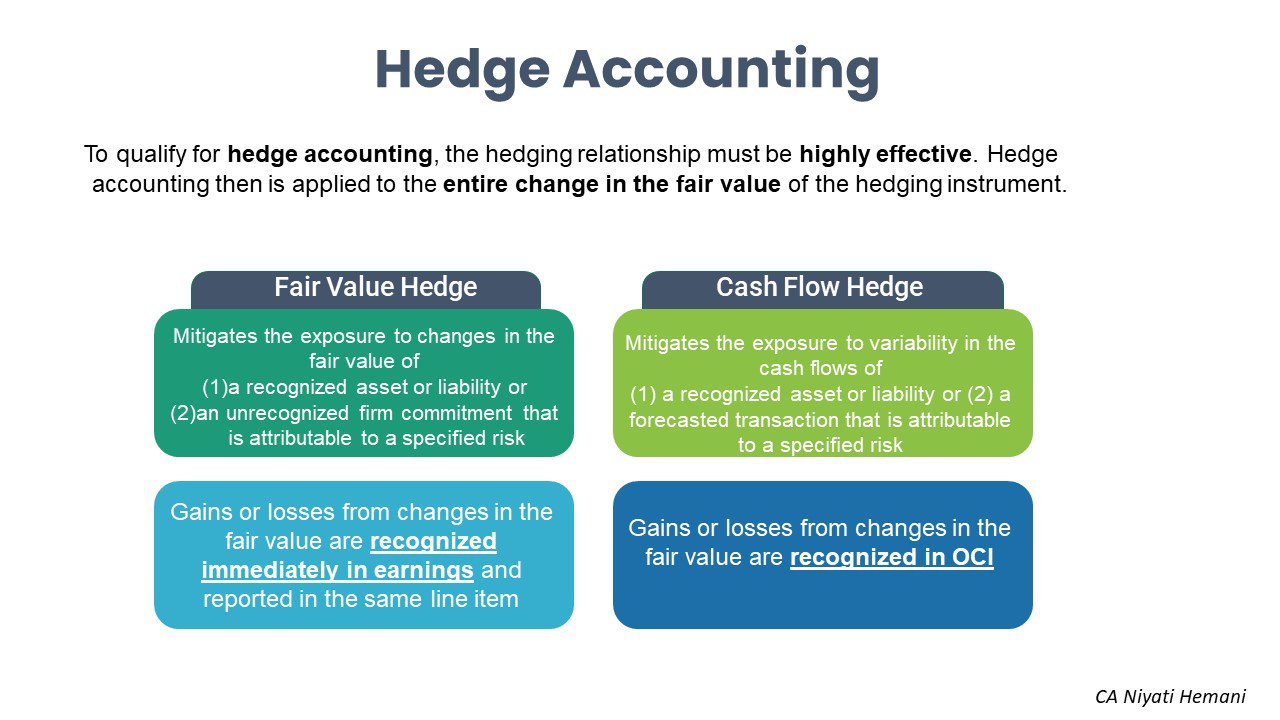

To qualify for hedge accounting, the hedging relationship must be highly effective. Hedge accounting then is applied to the entire change in the fair value of the hedging instrument.

A fair value hedge mitigates the exposure to changes in the fair value of (1) a recognized asset or liability or (2) an unrecognized firm commitment that is attributable to a specified risk.

- Gains or losses from changes in the fair value of the (1) hedging instrument and (2) hedged item are recognized immediately in earnings and reported in the same line item.

A cash flow hedge mitigates the exposure to variability in the cash flows of (1) a recognized asset or liability or (2) a forecasted transaction that is attributable to a specified risk.

-

- Gains or losses from changes in the fair value of the hedging instrument are recognized in OCI. These amounts are reclassified to earnings only when the hedged item affects earnings.

- They are reported in the same line item as the earnings effect of the hedged item