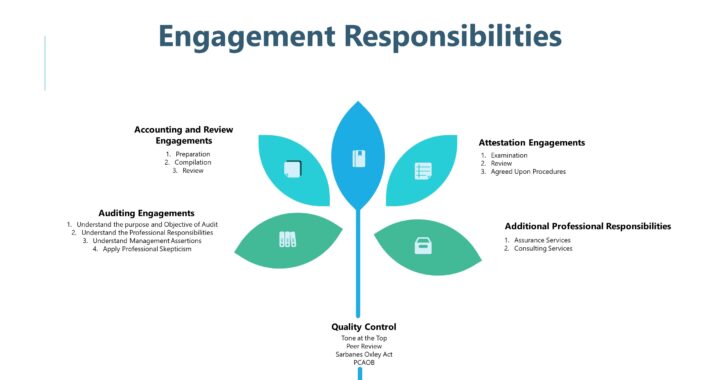

Audit Engagements

- Purpose of Audit is to provide users of financial with an opinion on whether the financial statements are presented fairly, in all material respects in accordance with the applicable financial reporting framework

- Objective of Audit is to (1) Obtain reasonable assurance (2) Express an Opinion (3) Report findings as required by GAAS (4) Be Independent and comply with relevant ethical rules

- Auditor to (1) Exercise professional judgement (2) With Professional Skepticism (3) Recognize that circumstances may exist that may cause the financial statements to be materially misstated (4) Obtain sufficient appropriate audit evidence to reduce audit risk to an acceptably low level (5) Auditors opinion enhances the degree of confidence that intended users can place in financial statements (6) Auditor uses relevant assertions to form a basis for the assessment of risks of material misstatements (RMM)

- Professional Skepticism includes a (1) A questioning mind (2) Alertness to conditions that may indicate material misstatement (3) Critical assessment of audit evidence

- Auditing Standards are concerned with (1) Quality of Audit Performance (2) Objectives to be attained. Generally accepted auditing standards are established by Auditing Standards Board and Public Company Accounting Oversight Board

- Auditing Interpretation are issued by Audit Issue Task Force of Auditing Standard Board (ASB) to provide timely guidance on the application of pronouncement of the ASB. They are not auditing standards.

Management Assertions

- Management Assertions on Financial Statements are for its (1) Completeness (2) Accuracy (3) Valuation & Allocation (4) Existence (5) Classification & Understandability (6) Rights & Obligations (7) Occurrence (8) Cutoff

Professional Responsibilities

1) Unconditional Requirements – Use of word ‘Must’ – Auditor must comply with an unconditional requirement

2) Presumptively Mandatory Requirements Use of word – ‘Should’ .When an auditor decides that such a departure is necessary, he/she should perform alternative audit procedures to achieve intent of the requirement

3) Word – May / Might / Could – Actions and Procedures that the auditor should use professional judgement in determining whether to perform

Accounting and Review Engagements

Preparation – It is a non-attest service and the accountant need not (1) verify the accuracy or completeness of management information (2) obtain evidence to express an opinion or conclusion (c) report on the financial statements

Preparation of financial statements requires compliance with Statements for Accounting and Review Services

Compilation – It is presentation in statement form of information without expressing any assurance thereon. It requires the accountant to (a) Determine that he is independent (b) Report on statements (c) Disclaim any assurance (d) Disclose any lack of independence and (e) Associate his name with the statements

Review – Objective is to obtain Limited Assurance as a basis of reporting if any material modification should be made to the statements. (a) Performed primarily through inquiry and analytical procedures (b) It is also known as negative assurance (c) Review does not contemplate consider internal controls (d) Review does not contemplate tests of transactions and account balances (e) Review does not contemplate other auditing procedures (f) Must issue a report

Attestation Engagements

CPA is engaged to issue an examination, a review or an agreed upon procedures report on the subject matter [point in time / period in time] which is the responsibility of another party. Example – (a) Historical or prospective performance or condition (b) Physical characteristics (c) Historical events (d) Analysis (e) Systems and Processes (f) Behavior

Independence is required for all attestation engagements. Written Assertion is required for Examination and Review but is not required for Agreed Upon Procedures. Opinion for is required for Examination and findings of specific procedure for Agreed Upon Procedures. Level of Assurance is High for Examination and Limited for Review. Working Papers are required for all attestation engagements.

Additional Professional Services

Assurance Services – Provides independent and professional opinions that reduce information risk (risk from incorrect information). Assurance services do not include

Assurance services do not require written assertions, unless services fall under AICPA’s attestation standards.

Consulting Services – They are professional services that use practitioner’s technical skills, education, observation, experiences and knowledge of consulting process. Should inform client of significant engagement findings. Primary objective is to provide the client with better outcomes through recommendations based on objectives of the engagement.

Quality Control

Quality control applies to Firms practice as a whole.

6 Elements of Quality Control are (1) Tone at the Top (2) Relevant Ethical Requirements (3) Acceptance and continuance of clients and engagements (4) Personnel Management (5) Engagement Performance (6) Monitoring

Peer Review

It is necessary part of the practice monitoring requirement for AICPA membership

Sarbens Oxley Act 2002

SOX is applicable to audit of public companies. Provision of SOX relate to improving quality control of audit and financial reporting. It requires second partner review and approval of audit reports. Lead auditor and reviewing partner must be rotated off audit every 5 years. CEO and CFO must certify the appropriateness of the financial statements and disclosures

Public Companies Accounting Oversight Board (PCAOB)

Required for audit of an issuer. Objective of reviewer is to evaluate the significant judgements made and related conclusions reached. The reviewer should evaluate (a) Assessment of and responses to significant risks (b) Engagement completion document and whether unresolved matters are significant (c) Significant judgements about planning matters

Assurance Services differs from Consulting service in 2 ways:

- a) Assurance focus is on improving information rather than providing advice;

- b) Assurance involves 2 party arrangements where one want to monitor another.

If you have found this blog to be useful, you may share with your friends. Thanks!