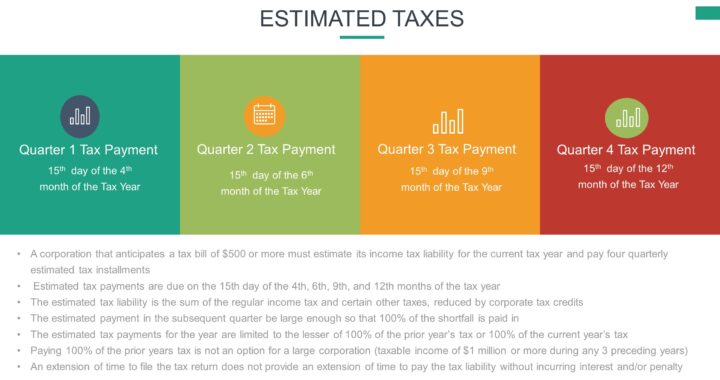

| Each quarterly estimated tax payment required is 25% of the lesser of 100% of the prior year’s tax, provided the tax liability existed and preceding tax year was 12 months (not for corporations with taxable income ≥ $1 million), 100% of the current year’s tax, or 100% of the annualized income (for corporations with uneven income). |

| The definition of tax for this purpose is found in Sec. 6655(f). This definition includes the alternative minimum tax. |

| An extension of time to file the tax return does not provide an extension of time to pay the tax liability without incurring interest and/or penalty. |

| Under Sec. 6655(d), the minimum installment is 25% of the required annual payment (the lesser of 100% of current tax or 100% of preceding year’s tax). |

| Paying 100% of the prior years tax is not an option for a large corporation. A large corporation is one with taxable income of $1 million or more during any 3 preceding years. Hence, Large corporations are not able to avoid underpaying their taxes by relying on the 100% of the tax shown on the return for the preceding year exception. |

| For the first quarter, estimated payments of large companies (taxable income greater than $1 million) should be 25% of the lesser of 100% of the current year’s tax or 100% of the prior year’s tax. Estimated payments of large companies (taxable income greater than $1 million) should be 25% of the current year’s tax for the second, third, and fourth quarter. |