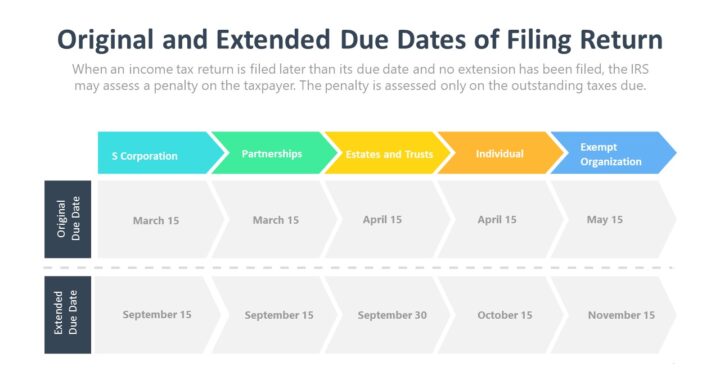

Original and Extended Due Dates of filing of return of income for a calendar year tax payer

| Return Type Original Due Date Extended Due Date S corporation March 15 September 15 Partnership March 15 September 15 Estate and trust April 15 September 30 Individual April 15 October 15 Exempt organization May 15 November 15 |

| A C corporation must file its return on or before the 15th day of the 4th month following the close of the tax year. For a calendar-year-end corporation, the due date for a tax return is 4/15/Yr 2. By filing Form 7004, the corporation receives an automatic 6-month extension for filing the tax return, which moves the due date to 10/15/Yr 2. However, the corporation must pay its estimated tax liability by the original due date. The time for payment of the taxes is not extended. |

| A calendar-year S corporation return is due on March 15 of the following year. Assuming delivery in due course, a postmarked date will be deemed the filing date. Returns filed early will be considered as filed on the last day prescribed for filing, which is March 15. Thus, the statute of limitations on this return will commence March 16, 2021. |