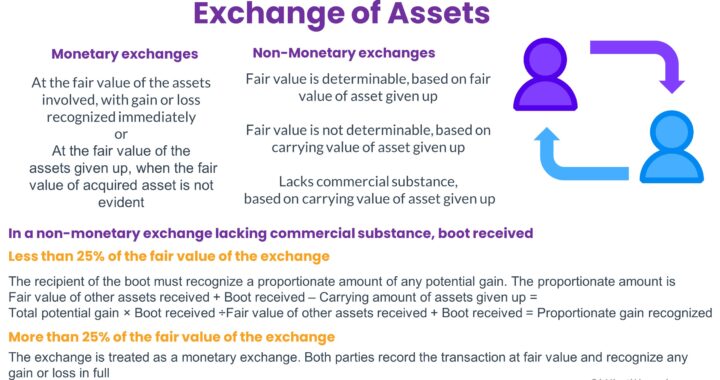

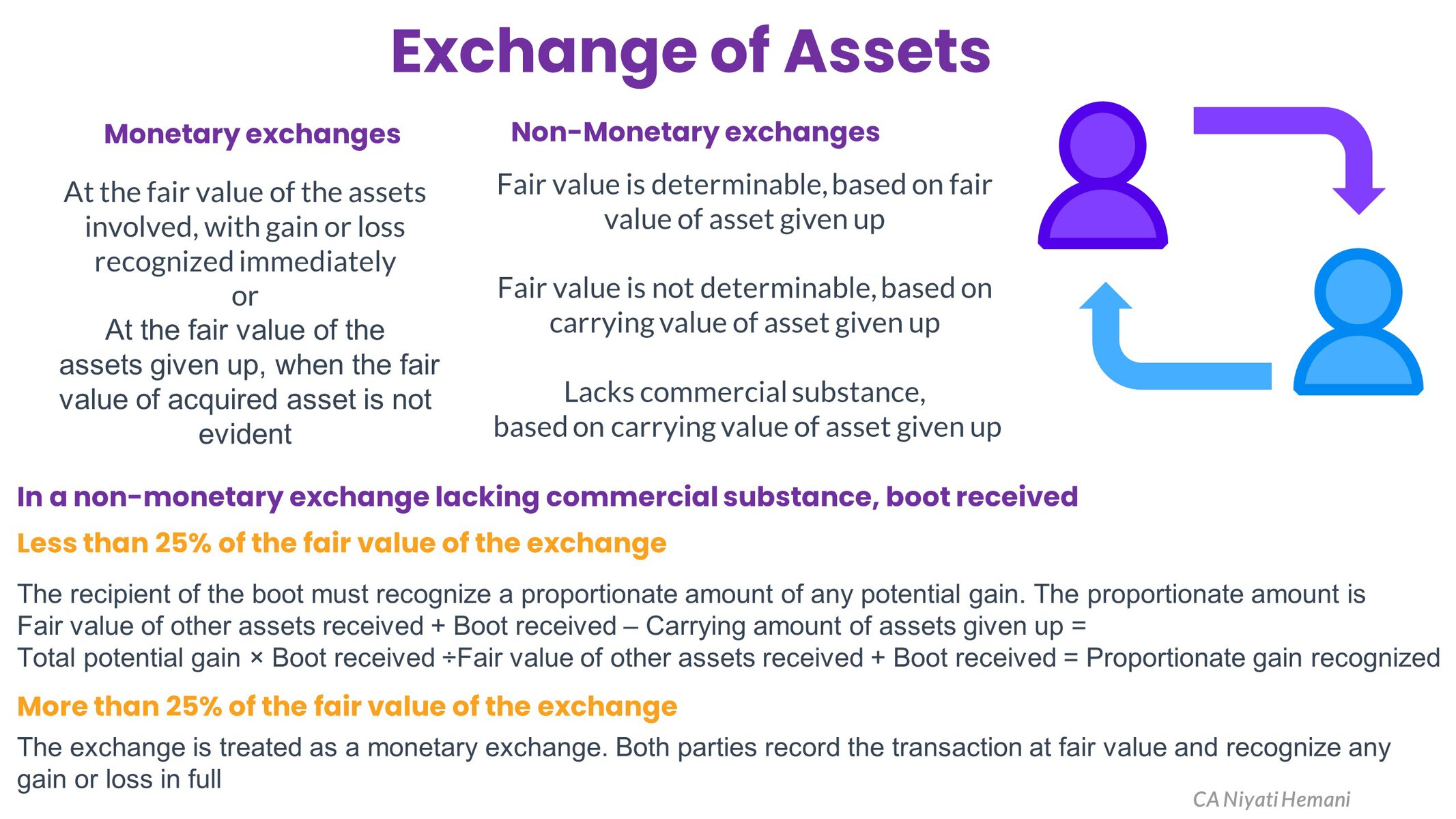

Exchanges are measured at fair value

Monetary exchanges - are measured at the fair value of the assets involved, with gain or loss recognized immediately

Nonmonetary exchange of assets - is treated as a monetary exchange when the fair value of both the assets is determinable

- The asset received is measured at the fair value of the asset given up, and

- Any gain or loss is recognized immediately

- The gain or loss is the difference between the fair value of the asset given up and its carrying amount

Gain (Loss) = Fair value of the asset given up - Carrying Amount of Assets given up

Boot

If one of the parties may transfer cash (boot) in addition to the nonmonetary asset:

- The party paying the boot includes this amount in the total fair value of assets given up in exchange

- The party receiving the boot measures the asset received at the fair value of the asset given up minus the boot

If the fair value of the asset given up is not known and the fair value of the asset received is determinable, the asset received is measured at fair value

Gain / (Loss) = Fair value of the asset received - Carrying amount of the asset given up

Exception - Exchange at carrying amount

Accounting for nonmonetary exchange is based on the carrying amount of the assets given up. Unless boot is received, no gain is recognized

This exception applied in the following circumstances:

- When neither the fair value of the assets given up nor the fair value of the assets received is reasonably determinable

- The exchange involves inventory sold in the same line of business that facilitates sales to customers not parties to the exchange, or

- That lacks commercial substance - An exchange lacks commercial substance when an entity's cash flows are not expected to change significantly

If an exchange is based on the carrying amount of the assets given up and the fair value of the asset to be exchanged is lower than its carrying amount:

- The total loss must be recognized for the difference

BOOT Received when an exchange is measured at Carrying Amount

An exception exists to the non-recognition rule (for gain) when the exchange involves BOTH a monetary and non-monetary asset being exchanged for another non-monetary asset. The monetary portion of the exchange is called "boot"

1. When BOOT <25% of the fair value of the exchange

The portion of the gain applied to the boot is considered realized and is recognized in the determination of net income in the period of exchange

Gain recognized = Boot * Potential Gain / (Boot + Fair Value of Non-monetary Asset Received)

Where the potential gain is arrived as under:

FMV of Asset received

+ Boot Received

- Carrying Value of Asset Given Up

============================

= Potential Gain (Total Gain indicated)

===========================

2. When BOOT >= 25% of the fair value of the exchange

The exchange is considered a monetary exchange and both parties record the exchange at fair value - Recognize the gain or loss in full

Treatment by paying entity

The entity paying the boot does NOT recognize gain and records the asset received at the sum of the boot plus the book value of the asset transferred

When this amount exceeds the fair value of the asset received, the asset received should be recorded at its fair value, with the difference recognized as a loss

If you have found this blog to be useful, you may share with your friends. Thanks!