Issuers sometimes retire debt before matutiry, for eg., to eliminate high-interest debt when rates are declining or to improve debt ratios

All extinguishment of debt before scheduled maturities are fundamentally alike and should be accounted for similarly

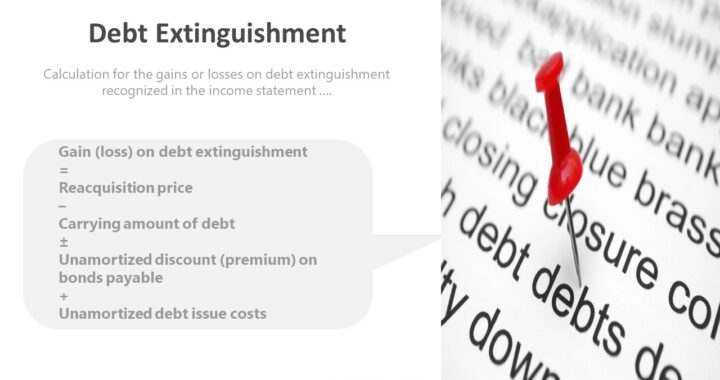

The net carrying amount is the amount due at maturity, adjusted for

- Unamortized premium (discount), and

- Cost of issuance

Gains or losses from early extinguishment should be:

- Recognized in income in the period of extinguishment, and

- Classified under continuing operations