GAAP establishes a framework for fair value measurements (FVMs) required by other pronouncements. Accordingly, they

- Define fair value

- Discuss valuation techniques

- Establish a fair value hierarchy of inputs to valuation techniques, and

- Require expanded disclosures about FVMs

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Thus, fair market measurement is market-based, not entity-specific

The fair value measurement considers attributes specific to the asset or liability eg. restrictions on sale or use, condition, and location

The price is an exit price paid or received in a hypothetical transaction considered from the perspective of a market participant

Valuation Techniques

- Market Approach: Based on the information, such as prices, from market transactions involving identical or comparable items

- Income Approach: Based on current market expectations about future amounts, such as earnings or cash flows

- Cost Approach: Based on current replacement cost, i.e. the cost to a market participant to buy or build an asset of comparable utility adjusted for obsolescence

Inputs to Valuation Techniques (Pricing assumptions of market participants)

- Observable Inputs: Based on market data obtained from independent sources

- Unobservable Inputs: Based on the entity's own assumption about the assumptions of market participants that reflect the best available information in the circumstances

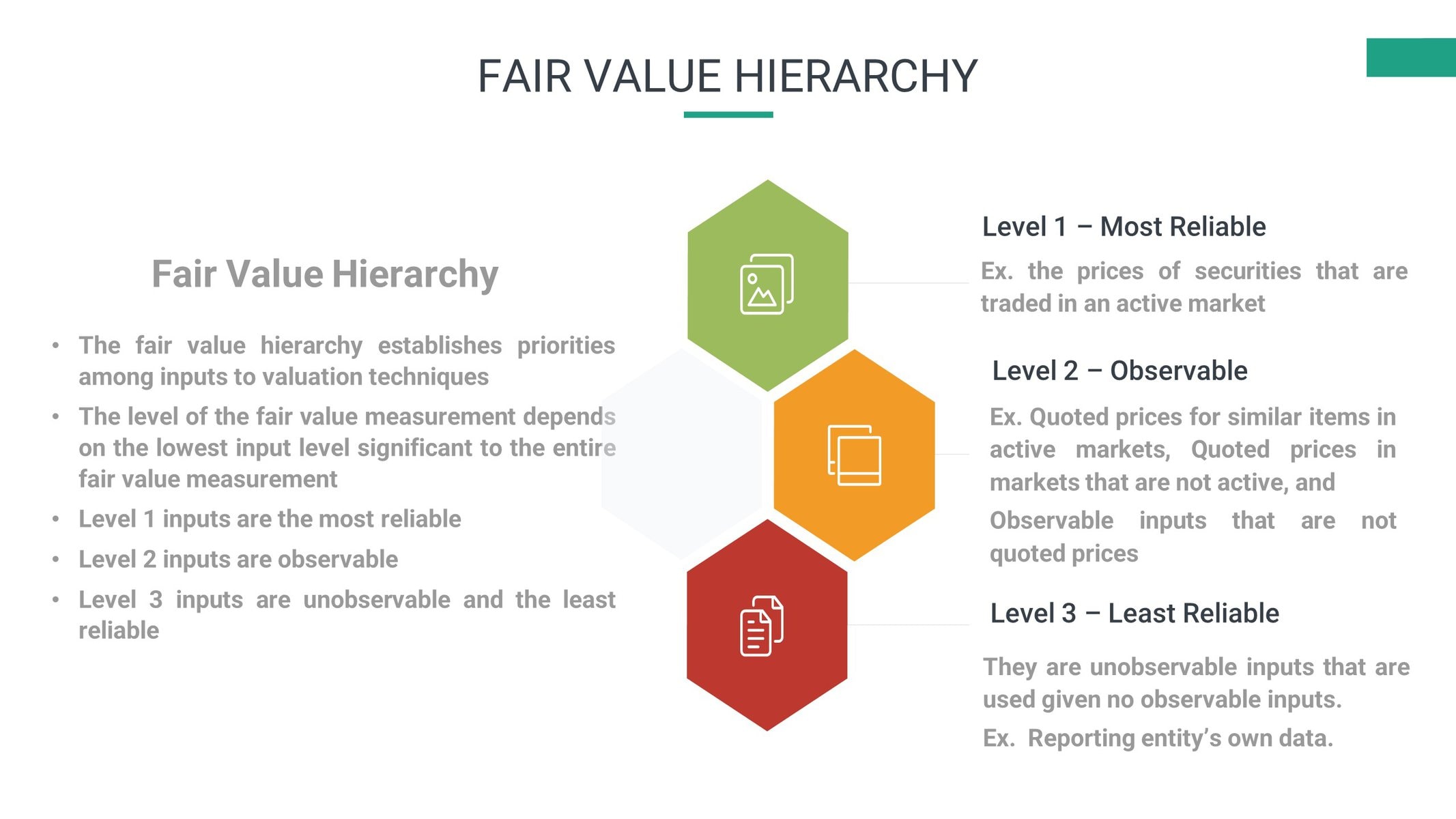

Fair Value Hierarchy

Fair Value Hierarchy establishes priorities among inputs to valuation techniques

- Level 1 Inputs are unadjusted quoted prices in active markets for identical assets (liabilities) that the entity can access at the measurement date

- Level 2 Inputs are observable (excluding Level 1 quoted prices). Examples are quoted prices for similar items in active markets, quoted prices in markets that are not active, and observable inputs that are not quoted prices

- Level 3 Inputs are unobservable. They are used in the absence of observable inputs and should be based on the best available information in the circumstances

Disclosures

One set of quantitative disclosures in tabular format is made for each major category of assets and liabilities measured at fair value on a recurring basis (eg. trading securities)

A reconciliation of the beginning and ending balances is required for any assets or liabilities measured at fair value on a recurring basis that use significant unobservable inputs (level 3) during the period

For each major category of assets and liabilities measured at fair value on a nonrecurring basis (eg. impaired assets) during the period, quantitative disclosures also must be made in tabular format.

If you have found this blog to be useful, you may share with your friends. Thanks!