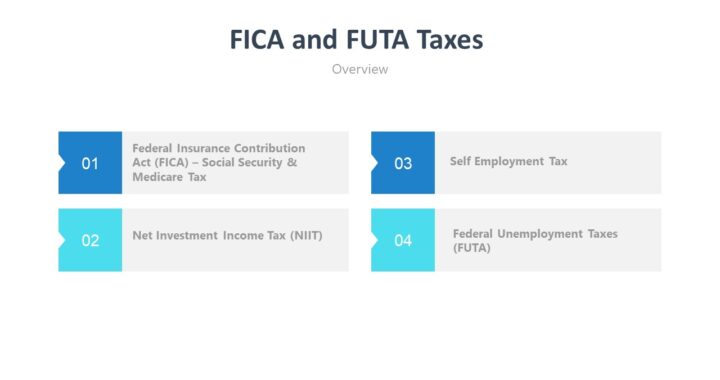

FICA taxes are imposed on both employers and employees.

FUTA taxes are imposed on employers only.

FICA

Employers and employees are each liable for FICA taxes. Under Sec. 3102(a), an employer is liable for collecting (withholding) the employees’ tax from wages. Employers who fail to collect these taxes are responsible for the employees’ tax, in addition to their own [Sec. 3111(a)]

The Social Security tax imposed by the Federal Insurance Contribution Act (FICA) applies to virtually all compensation received for employment, including money or other forms of wages, bonuses, commissions, vacation pay, severance allowances, and tips. Reimbursements by one’s employers for medical and hospital expenses that are not included in gross income are not subject to FICA [Sec. 3121(a)(2)]. However, sick pay, which is a wage payment paid when unable to work, is subject to FICA.

The employer’s portion of FICA tax is the sum of 2 tiers:

Tier Employee’s Wages (for 2020 / 2021) FICA Tax

1 $0 to $137,700 /$1,42,800 Wages × 7.65%

2 $137,700 / $1,42,800 or above Wages × 1.45%

The employee’s portion of FICA tax is the sum of 3 tiers:

Tier Employee’s Wages (for 2020 / 2021) FICA Tax

1 $0 to $137,700 /$1,42,800 Wages × 7.65%

2 $137,700 / $1,42,800 to $200,000 Wages × 1.45%

3 Above $200,000 Wages × 2.35%

($250,000 MFJ, $125,000 MFS)

FUTA

An employer that (1) employs one or more persons covered by the Social Security Act for at least part of a day in each of 20 different calendar weeks in a year or the preceding year or (2) pays wages of $1,500 or more during any calendar quarter in a year or the preceding year must pay a federal unemployment tax on the first $7,000 of each employee’s wages [Sec. 3306(a)].

Under Sec. 3306(b)(1), wages are taxed for federal unemployment taxes up to $7,000 for each employee. Wages earned in excess of $7,000 are not subject to federal unemployment taxes

If you have found this blog to be useful, you may share with your friends. Thanks!