Financial modeling is an invaluable tool for businesses, providing insight into their financial information and allowing them to make informed decisions. A successfully created financial model should provide the user with an understanding of the current financial structure of the business, as well as potential future scenarios.

Key elements to a successful financial model

The three key elements that make a successful financial model are good design, data flow, and communication. Poor design can lead to excel models that are inaccurate and not useful for making critical business decisions. Good modelling skills, financial negotiation and budgeting, and the ability to communicate clearly are essential for modelling success. A financial model should be tailored to the company’s needs and incorporate their financial, operational, and legal information.

Financial Modeling requires a multi-disciplinary approach

Financial Modelling is an important skill in business as it allows multiple parties to come together, understand one another’s financial standing and make decisions that are best for the company. Like most skills, financial modelling takes practice to excel. It is not just an individual skill, but a multi-disciplinary one that encompasses various fields like finance, accounting, engineering, and data communication.

The creation of a financial model involves the incorporation of financial knowledge, accounting principles and data analysis skills. As well as being able to work with quantitative data, the financial modeler must also be able to interpret and explain the model’s results. A successful modeler must also work well with others, validate assumptions, and ask the right questions. The creation of a financial model also requires the modeler to take into account the potential risks and uncertainties that may affect the future outcomes of the company.

Financial modelling involves breaking a problem up into its separate individual components. This allows the modeller to focus on details and get a better understanding of the situation overall. With an understanding of the individual pieces, the modeller can then create an interrelated system of equations that represent the problem. This then allows for a more complete understanding of the financial system or process as a whole.

Custom made financial models

When financial modelling, it's also important to understand the audience who will be affected by it. Knowing who the audience is and their needs will help determine the best approach to take in creating the model. This can range from the technical details like which variables to include, to the overall design of the model. By understanding these variables, the model can be tailored more accurately to what the individual needs.

Communication is essential for an effective financial model

The final step of financial modelling is communication. This is where storytelling comes in. Models should be presented in a way that highlights the key elements while being easy to understand. The ultimate goal is to make a presentation that has the audience thinking and make decisions that are best for the company. This is where reflection is key. Knowing your audience and understanding what they need and want is important when presenting a model. Creating an output page and assumptions page to capture the key numbers is important for making decisions.

While excel sheets are the foundation of an efficient financial model, there is more to the practice than this. Poor model design, incorrect assumptions, and lack of communication between modelers and stakeholders can all lead to a model's downfall. That is why successful financial modelling requires a holistic approach that combines technical and non-technical skills. It is important to take the time to understand stakeholders expectations and to effectively communicate the results of the model. Storytelling and focusing on the key points to clearly communicate the model to all relevant parties is essential.

Checks and balances and having an internal committee

To ensure that the financial modelling is accurate and reasonable, using a system of checks and balances is essential. This means creating a model that will be easy to audit and verify with your data and sources, while still being flexible enough to accommodate changes. The model should be thoroughly tested, reviewed, and monitored to make sure that it will provide reliable information and results. The financial model should also be regularly updated as circumstances change

Having an internal committee with regular meetings and a general approach for modelling can help structure the process and make sure that everyone is on the same page. As financial modelling is key to making informed business decisions, having a system in place can help ensure accuracy and minimize errors.

Utility of Financial Modeling

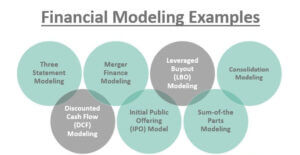

Financial modeling can be used for various purposes viz.

- valuation of a company;

- acquisitions / mergers;

- raising capital;

- competitor analysis;

- risk mitigation;

- periodic assessment;

- funding strategy etc.

Conclusion

Financial modelling involves an intricate process of collecting and analyzing data, constructing appropriate models, and testing to ensure accuracy and reliability. Financial modelling requires an understanding of technical and non-technical skills. A successful financial modeler must be an expert in Excel, understand the nuances of how companies work, and have strong communication, people, and judgement skills. They must also be open-minded to change, have the ability to think holistically, and be willing to step out of their comfort zone. Effective financial modelling requires discipline, creativity, and commitment to the overall design and flow structure of the model. With these concepts, one can create an effective and accurate financial model that can be used to make informed decisions for the company.

In conclusion, financial modelling is a powerful tool that can be used to evaluate and forecast the impacts of different business strategies. By selecting the right modelling approach, using the latest data and techniques, and being open to change, businesses can create an effective and accurate financial model that can be used to make informed decisions for the company.

PS: This blog is based on a podcast by FP&A Today on "Going from good to great in financial modeling" by Paul Barnhurst and Ian Schnoor. For more resources on FP&A, do subscribe to its podcast and/or visit – https://www.thefpandaguy.com/