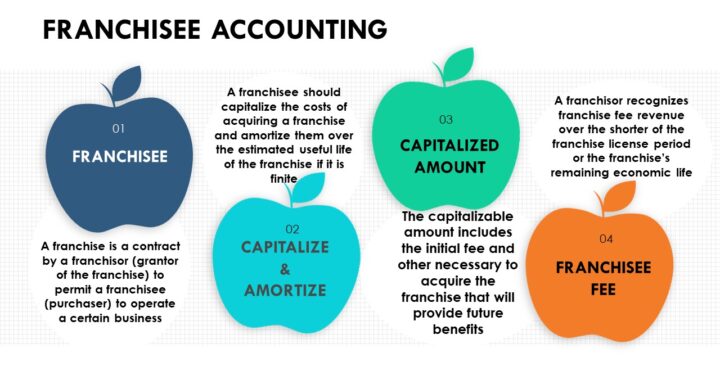

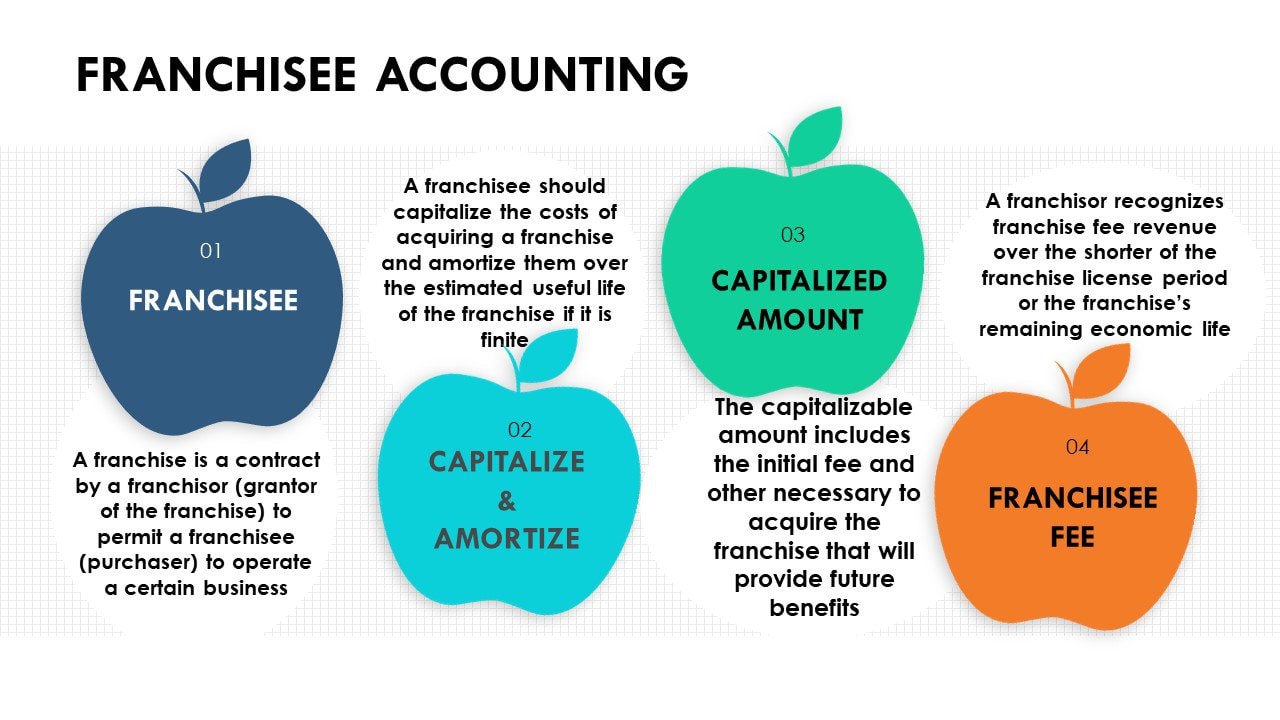

A franchise is a contractual agreement by a franchisor to permit a franchisee to operate a certain business

Franchisee Accounting

The franchisee should capitalize the costs of acquiring the franchise such as the initial fee and other expenditures (eg. legal fees) incurred to acquire the franchise

Franchise costs are amortized over their estimated useful life

Future payments based on a percentage of revenues or for franchisor services are expensed as incurred

Franchisor Accounting

A franchise right is considered symbolic intellectual property. Eg include brand names and logos

Revenue from a license of the right to access symbolic IP is recognized over time

Hence, franchise fee revenue is recognized over the franchise license period

Hence, franchise fee revenue is recognized over the franchise license period

- Revenue from initial fixed fees received is recognized evenly over the entire franchise license period

- Revenue from sales-based royalties is recognized when the sales occur

If you have found the blog to be useful, you may share with your friends. Thanks!