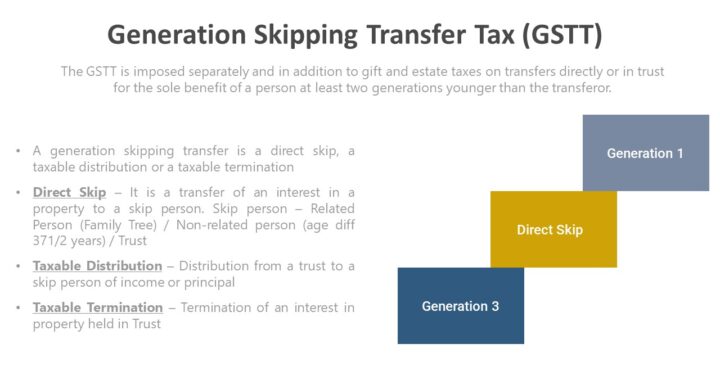

The Generation-Skipping Transfer Tax is imposed separately and in addition to gift and estate taxes on transfers directly or in trust for the sole benefit of a person at least two generations younger than the transferor.

A generation-skipping transfer is defined as a taxable termination, a taxable distribution, or a direct skip [Sec. 2611(a)]. A taxable termination is the termination of a non-skip person’s interest held in trust, after which only a skip person has an interest [Sec. 2612(a)(1)]. A taxable distribution means any distribution from a trust to a skip person if it is not a taxable termination or a direct skip [Sec. 2612(b)]. A direct skip is a transfer subject to the estate tax or the gift tax of an interest in property to a skip person. A skip person is a natural person assigned to a generation that is two or more generations below the generation assignment of the transferor or a trust where all interests are held by skip persons [Sec. 2613(a)].

Younger generations refer to generations younger than the transferor’s generation. An individual who is a lineal descendant of a grandparent of the grantor is assigned to that generation that results from comparing the number of generations between the grandparent and such individual with the number of generations between the grandparent and the transferor [Sec. 2651(b)(1)]. An individual who has been married to the transferor is assigned to the transferor’s generation [Sec. 2651(c)(1)].

If age difference falls within the 37 1/2-year to 62 1/2-year range constitutes two generations.

If you have found this blog to be useful, you may share with your friends. Thanks!