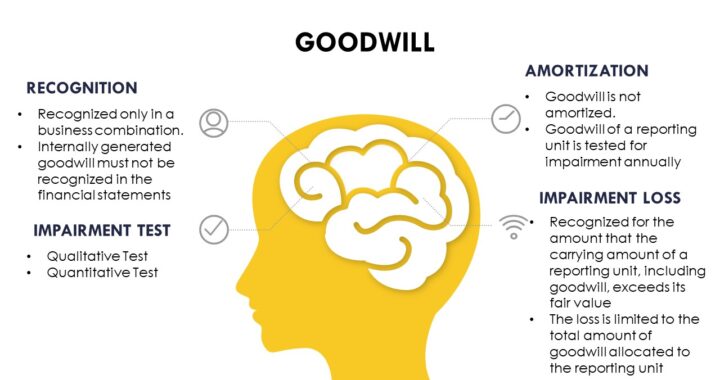

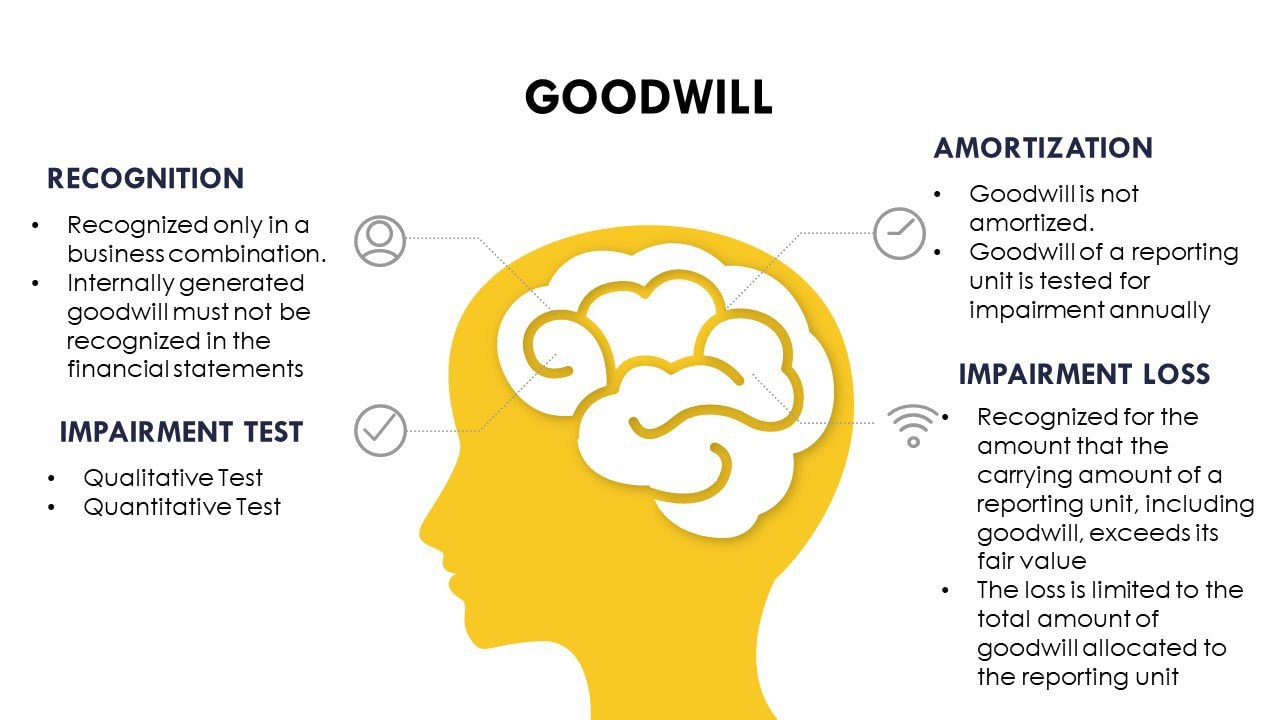

Goodwill is recognized only in a business combination

It is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized

The initially recorded amount is the difference between the cost of the enterprise acquired and the sum of the assigned costs (fair value) of the net identifiable assets

Internally generated goodwill must not be recognized in the financial statements. Goodwill is not amortized.

All goodwill is assigned to the reporting units that will benefit from the business combination

Goodwill Impairment Test

Goodwill is tested for impairment for each balance sheet date. Potential impairment of goodwill is deemed to exists only if the carrying amount (including goodwill) of a reporting unit is greater than its fair value

Qualitative Test

Prior to performing the qualitative goodwill impairment test, the entity may elect to make a qualitative assessment. Qualitative assessment includes industry & market conditions, cost increases, overall financial performance, other entity-specific events, and events affecting the reporting unit

Quantitative Test

The quantitative test need not be performed if the qualitative assessment does not indicate impairment. If a potential impairment is found, then the following two-step quantitative test is performed:

Step 1:

Calculate the fair value of the reporting unit and compare it with its carrying amount including goodwill

- If the fair value is greater than the carrying amount, no impairment loss is recognized

- If the fair value is less than the carrying amount, perform step 2

Step 2:

Calculate and compare the implied fair value of the reporting unit goodwill with the carrying amount of that goodwill

- An impairment loss not exceeding the carrying amount of goodwill is then recognized equal to any excess of that carrying amount over the implied value

- The loss is non-reversible

Disposal of a Reporting Unit

In the calculation of the gain or loss on disposal of a reporting unit, goodwill is included as part of its carrying amount

Presentation

Balance Sheet

- Intangible assets are required to be presented, at a minimum, as a single aggregated line item

- Goodwill is presented in the aggregate as a separate line item

Income Statement

- Amortization expense and impairment losses related to intangible assets are presented as line items under continuing operations

- The aggregate goodwill impairment loss is presented as the last separate line item before the subtotal income from continuing operations

If you have found this blog to be useful, you may share with your friends. Thanks!