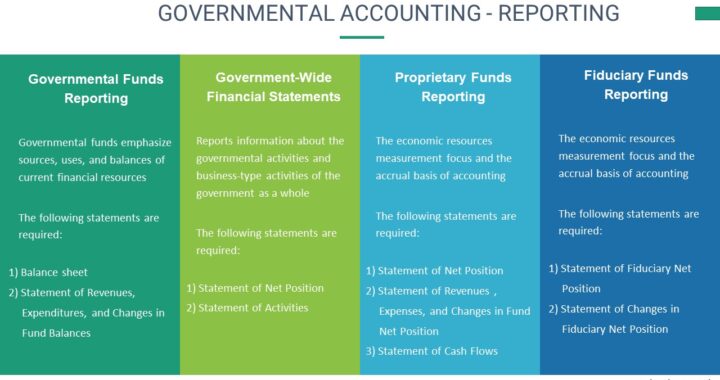

1. Governmental Funds Reporting

Governmental funds emphasize sources, uses, and balances of current financial resources.

Major vs. nonmajor fund reporting. The focus of governmental and enterprise fund financial statements is on major funds. Each major fund is presented in a separate column.

- The main operating fund (i.e., the general fund) is always reported as a major fund.

- Nonmajor funds are aggregated in one column. Combining statements are not required for nonmajor funds.

The following statements are required:

- Balance sheet

- Statement of revenues, expenditures, and changes in fund balances

2. Government-Wide Financial Statements

The government-wide financial statements do not display funds or fund types but instead, report information about the governmental activities and business-type activities of the government as a whole.

- Governmental activities are normally financed by non-exchange revenues (taxes, etc.). They are reported in governmental and internal service funds.

- Business-type activities are financed at least in part by fees charged to external parties for goods and services. They are usually reported in enterprise funds.

The statement of net position reports all financial and capital resources. Net position is reported in the following components: (1) net investment in capital assets, (2) restricted net position and (3) unrestricted net position.

The statement of activities displays net expenses or revenue for each function. Direct expenses must be reported by function, and program revenues and general revenues are separately reported.

3. Proprietary Funds Reporting

The economic resources measurement focus and the accrual basis of accounting are required in the proprietary fund financial statements. The following statements are required:

- Statement of net position

- Statement of revenues, expenses, and changes in fund net position

- Statement of cash flows

4. Fiduciary Funds Reporting

The economic resources measurement focus and the accrual basis of accounting are required in the fiduciary fund financial statements. The following statements are required:

-

- Statement of fiduciary net position

- Statement of changes in fiduciary net position