The reporting entity consists of the primary government and its component units, which is a legally separate organization for which the primary government is responsible.

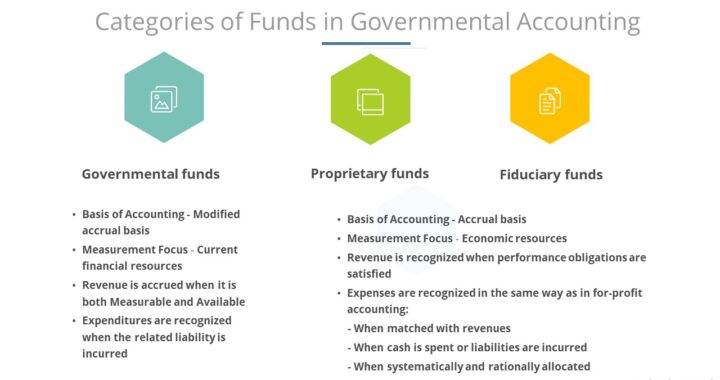

The basis of accounting is the timing of the recognition of economic events or transactions. Measurement Focus is what is measured and tracked.

Governmental funds use a modified accrual basis. The measurement focus is on current financial resources.

The accrual basis is used to report - 1) government-wide, 2) proprietary fund, 3) fiduciary fund statements. The measurement focus is on economic resources.

A fund is an independent, distinct fiscal and accounting entity with a self-balancing set of accounts related to activities or objectives subject to regulations or limitations.

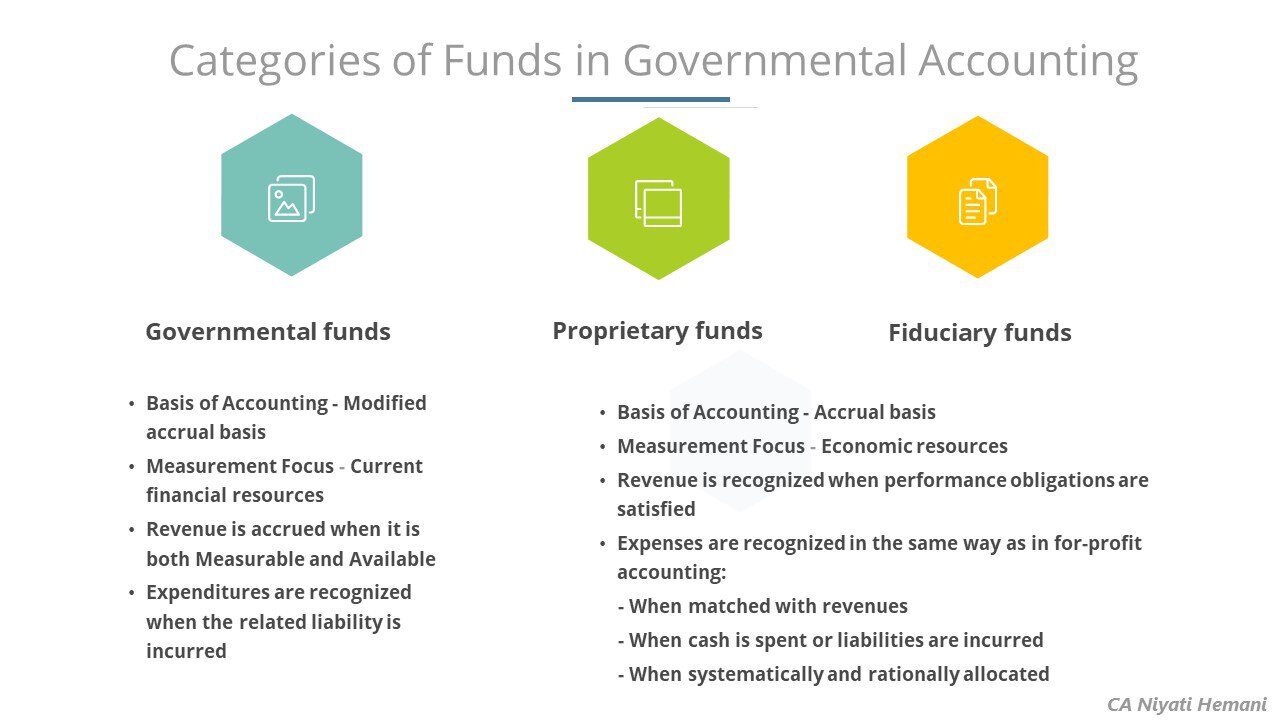

- Governmental funds emphasize fiscal accountability, account for the nonbusiness activities of a government, and are generally financed through taxes.

- Proprietary funds emphasize operational accountability. They account for information about business-type activities and their economic resources. They serve defined customer groups and are generally financed through fees.

- Fiduciary funds provide operational information and account for amounts held in a custodial capacity.

| Governmental Funds | Proprietary Funds | Fiduciary Funds |

| General fund | Enterprise funds (emphasis | Pension (and other employee |

| Special revenue funds | on major funds) | benefit) trust funds |

| Capital projects funds | Internal service funds | Investment trust funds |

| Debt service funds | Private-purpose trust funds | |

| Permanent funds | Custodial funds |

Classification of Fund Balance

Fund balance is reported only for a governmental fund. It is classified according to the limits on the specific purposes for which resources may be spent. The following is the hierarchy of classifications:

- Non-spendable

- Restricted

- Committed

- Assigned

- Unassigned

Funding Sources

Nonexchange transactions are the main sources of revenues.

- Derived tax revenues are assessments on exchange transactions. The primary examples are income taxes and sales taxes.

- Imposed nonexchange revenues are assessments on nongovernmental entities. Examples are property taxes, fines, and forfeitures.

- Voluntary nonexchange transactions result from agreements entered into willingly by the parties.

- Government-mandated nonexchange transactions occur when one government provides resources to a government at another level and requires that they be used for a specific purpose. An example is a federal grant.

Supplemental funding can be provided by nonrevenue sources of funding.

- Long-term debt (bonds), although not a revenue, is a source of funding for governmental units.

- Special assessments result from arrangements by which governments agree to construct physical improvements to benefit one or more property owners. The government issues debt, pays for the improvements, and repays the debt with reimbursements from the property owners.

- Interfund activity may be reciprocal (interfund loans and interfund services) or nonreciprocal (interfund transfers and interfund reimbursements).