This applies to the long-lived assets of an entity that are to be held and used or disposed of

Although lower cost or market rule does not apply to Property, Plant, and Equipment, their permanent decline in value should be recognized

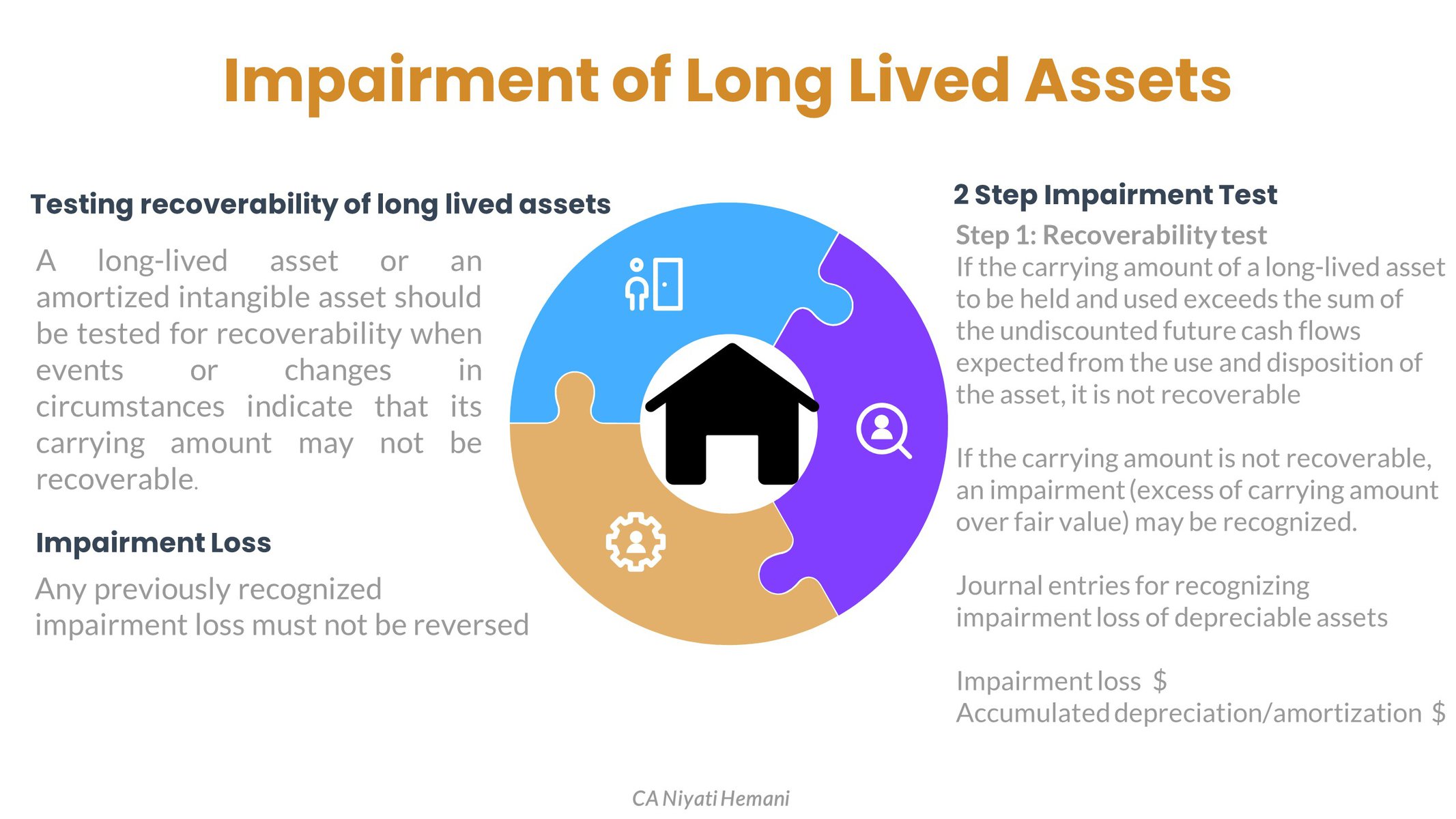

Impairment is the condition that exists when the carrying amount of a long-lived asset exceeds its fair value

Review for impairment only when the events and circumstances indicate that the carrying value of the asset may not be recoverable. Impairment losses are only recognized when the carrying amount of the impaired asset is not recoverable

Frequency of testing:

There is no set interval or frequency for testing for impairment, unlike the annual requirement for testing goodwill for impairment

Testing for impairment:

Step 1:

Compare the carrying amount of the asset with the undiscounted cash flows expected to result from its use and eventual disposition

- If the sum of the undiscounted future cash flows is more than the carrying value, impairment is not required

- If the sum of the undiscounted cash flows is less than the carrying value, impairment is not required

Step 2:

Calculate the present value of the undiscounted future cash flows

Impairment Loss = Carrying Value of the asset - PV of future cash flows

Impairment of Long-lived asset to be held and used

Report an impairment loss in income from continuing operations before income taxes. Restoration of the impairment loss is not allowed

Disclosures:

- A description of the asset and the circumstances of the impairment

- The amount of the loss

- The methods used to measure fair value

- The segment in which the impaired asset is reported

If you have found this blog to be useful, you may share with your friends. Thanks!