The asset and liability approach is used to account for income taxes

The tax consequences of some transactions or events may be recognized in income taxes currently payable or refundable in a year different from that in which their financial statement effects are recognized (temporary differences)

Also, some transactions or events may have tax consequences or financial-statements effects, but never both (permanent differences)

The following are the basic principles of income tax accounting

- Income tax expense (benefit) recognized in the financial statements is the sum of (1) current tax expense (benefit) and (2) deferred tax expense (benefit)

- Current tax expense (benefit) equals taxable income (or excess of deductions over revenues) times the tax rate. This amount equals income taxes paid or payable for the year

- Deferred tax expense (benefit) is the net change during the year in an entity's deferred tax amounts

- A deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards

- A deferred tax asset is reduced by a valuation allowance if it is more likely than not that some portion will not be realized

Income Tax Accounting - Temporary and Permanent Differences

Taxable temporary differences give rise to future taxable amounts and deferred tax liabilities

Deductible temporary differences give rise to future deductible amounts and deferred tax assets

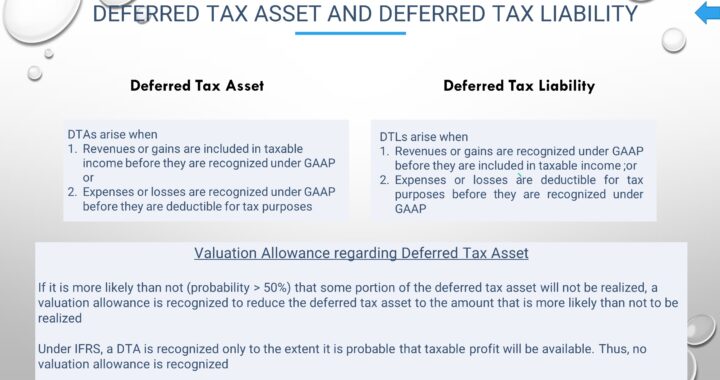

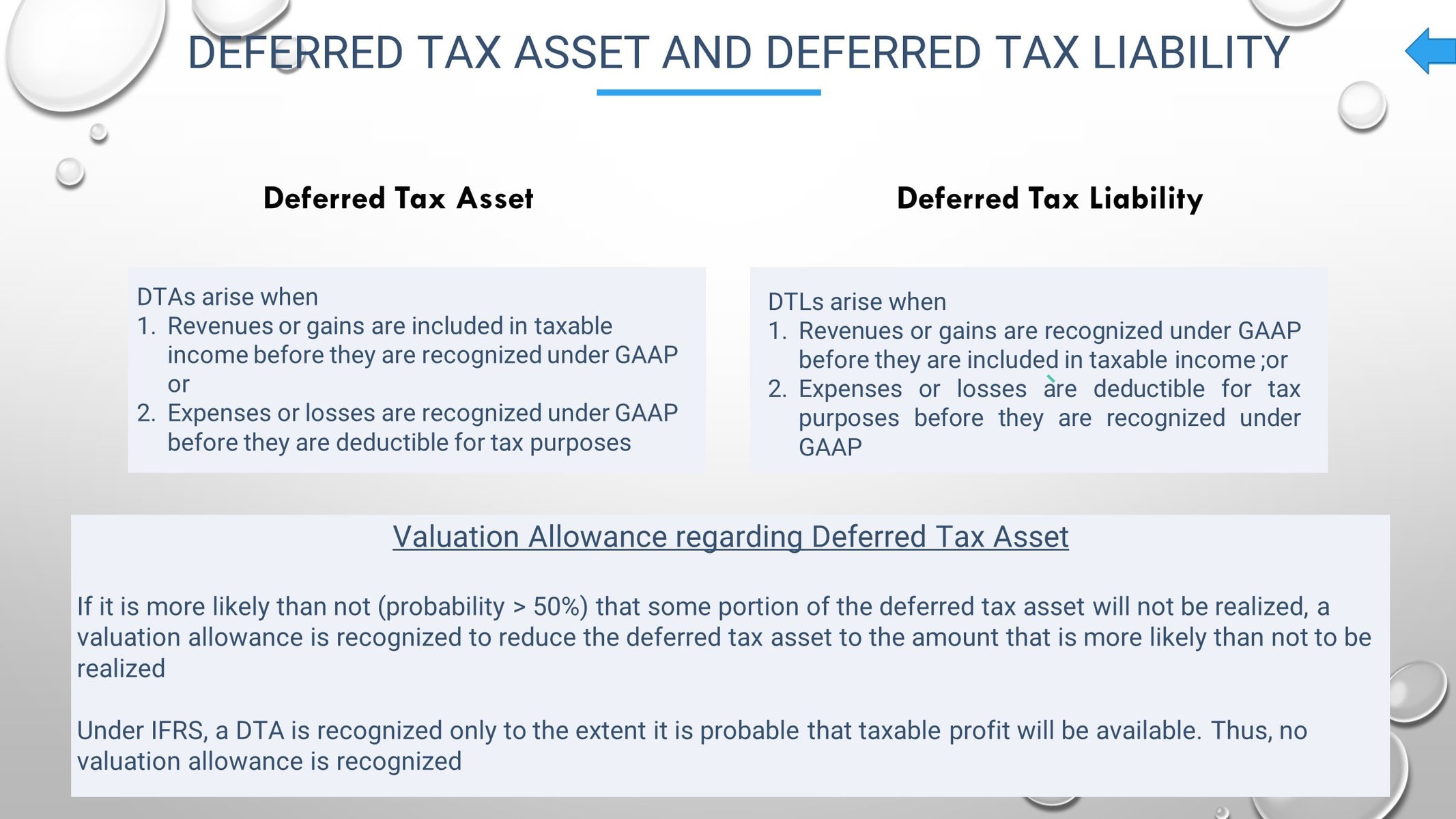

Deferred Tax Liabilities (DTLs) and the related future taxable amounts arise when revenues or gains are recognized under GAAP before they are included in taxable income

Deferred Tax Assets (DTAs) are the related future deductible amounts that arise when revenues or gains are included in taxable income before they are recognized under GAAP

DTAs also arise when expenses or losses are recognized under GAAP before they are deductible for tax purposes

Permanent differences have no deferred tax consequences. They consist of:

- Income items included in net income but not taxable income

- Items subtracted in calculating net income but not taxable income, and

- Items subtracted in calculating taxable income but not net income

Income Tax Accounting - Applicable Tax Rate

A deferred tax amount is measured using the enacted tax rate(s) expected to apply when the liability or asset is expected to be settled or realized

Income Tax Accounting - Recognition of Tax Expense

The following process for determination of deferred taxes is performed for each taxpaying entity in each tax jurisdiction:

- Identify temporary differences (types and amounts) and operating loss and tax credit carryforwards (nature and amounts of each type and the remaining carryforward period)

- Measure the total DTL for taxable temporary differences using the applicable tax rate

- Measure the total DTA for deductible temporary differences and operating loss carryforwards using the applicable tax rate

- Measure DTAs for each type of tax credit carryforward

- Recognize a valuation allowance if necessary

Valuation Allowance

A valuation allowance reduces a deferred tax asset. It is recognized if it is more likely than not (probability > 50%) that some portion of the deferred tax asset will not be realized.

Income Tax Accounting - Other Issues

Entities with net operating losses can obtain the tax benefit of the loss by carrying the loss forward or back

In the statement of financial position, deferred tax liabilities and assets and any valuation allowance are netted and presented as a single noncurrent amount

If you have found the blog to be useful, you may share with your friends. Thanks!