Intangible Assets lacks physical substance

- Intangible assets may convey to the holder a contractual or legal right to receive future economic benefits (eg. patents, leaseholds, or franchises)

- Another type of intangible asset reflects costs not assignable to specific products or services but that are expected to have future economic benefits (eg. customer lists, noncontractual customer relationships, and unpatented technology)

Externally Acquired: Intangibles other than goodwill are initially recorded at acquisition cost plus any incidentals such as legal fees

Internally Acquired: Intangibles other than goodwill are initially recorded at incidental costs (eg. legal fees) only. Most of the costs of an internally generated intangible asset consist of research and development (R&D) which must be expensed as incurred

Certain costs associated with intangibles that are specifically identifiable can be capitalized:

a. Legal Fees and other costs related to a successful defense of the asset

b. Registration or Consulting fees

c. Design costs (eg. of trademark)

d. Other direct costs to secure the asset

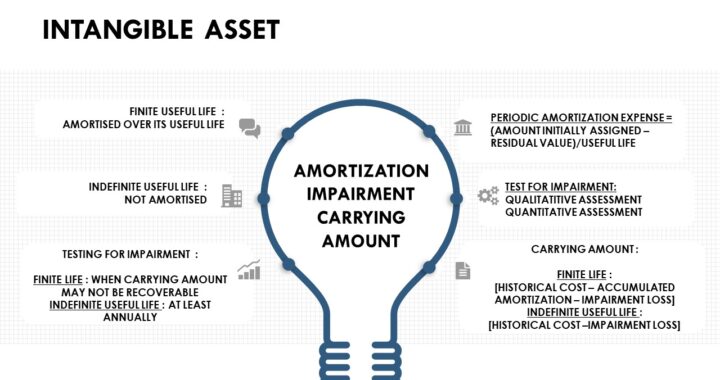

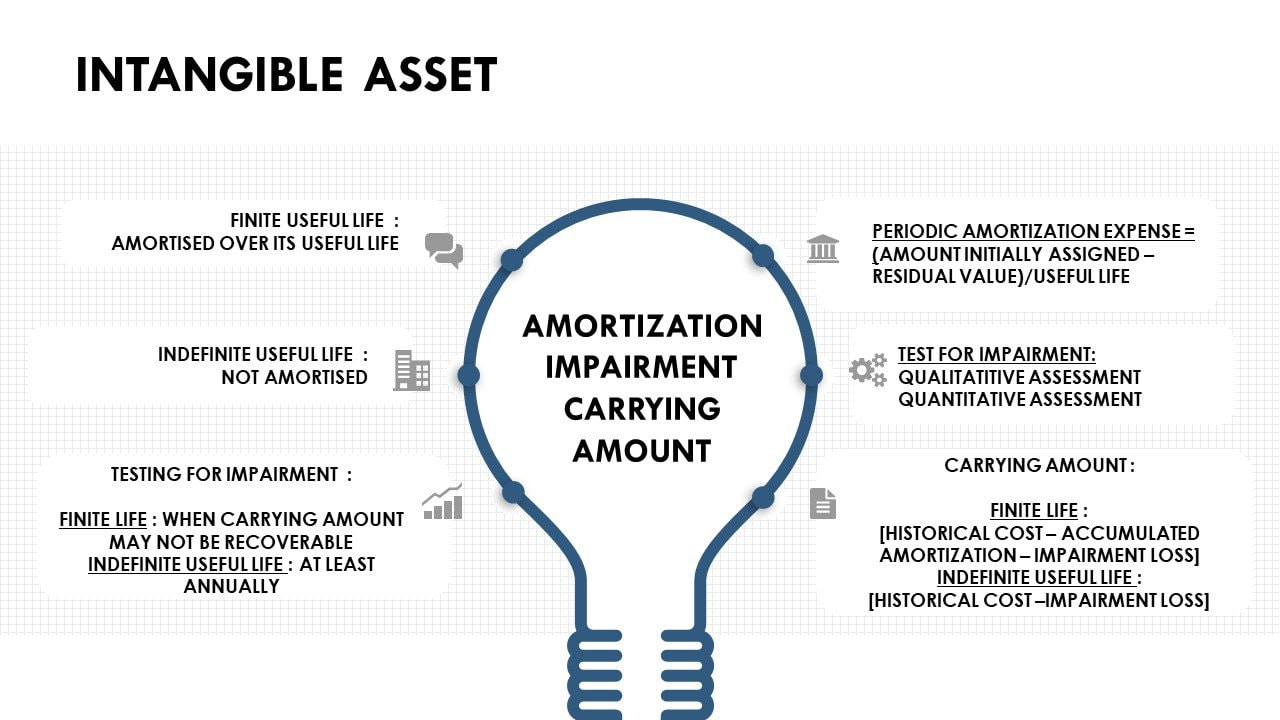

Amortization of Intangible Asset

An intangible asset with a finite useful life is amortized over their useful life

- The useful life of an asset is the period during which it is expected to contribute either directly or indirectly to the future cash flows of the reporting entity

Finite Useful Life

- An intangible asset with a finite useful life to the reporting entity is amortized over the useful life

- Useful life should be reevaluated each reporting period. A change in the estimate results in a prospective change in amortization

- Amortization is based on the pattern of consumption of economic benefits, if reliably determinable. Otherwise, the straight-line method must be used

- The amortizable amount equals the amount initially assigned minus the residual value

Infinite Useful Life

- An Intangible with an indefinite useful life is NOT amortized

- If an amortized intangible asset is later determined to have an indefinite useful life, it must (1) no longer be amortized, and (2) be tested for impairment

- A non-amortized intangible asset must be reviewed for impairment atleast annually

Impairment of Intangible Asset

An amortized intangible asset is reviewed for impairment when events or changes in circumstances indicate that its carrying amount may not be recoverable

An impairment loss is recognized only if:

- The carrying amount is not recoverable, and

- The carrying amount is greater than the asset's fair value

The impairment test is met if the sum of the undiscounted expected future cash flows from the asset is less than the carrying amount. The loss recognized is the excess of that carrying amount over the fair value

Carrying Amount

The carrying amount of an intangible asset is the amount at which it is reported in the financial statements

Useful Life Carrying Amount

Finite Historical Cost - Accumulated Amortization - Impairment Losses

Indefinite Historical Cost - Impairment Losses

If you have found this blog to be useful, you may share with your friends. Thanks!