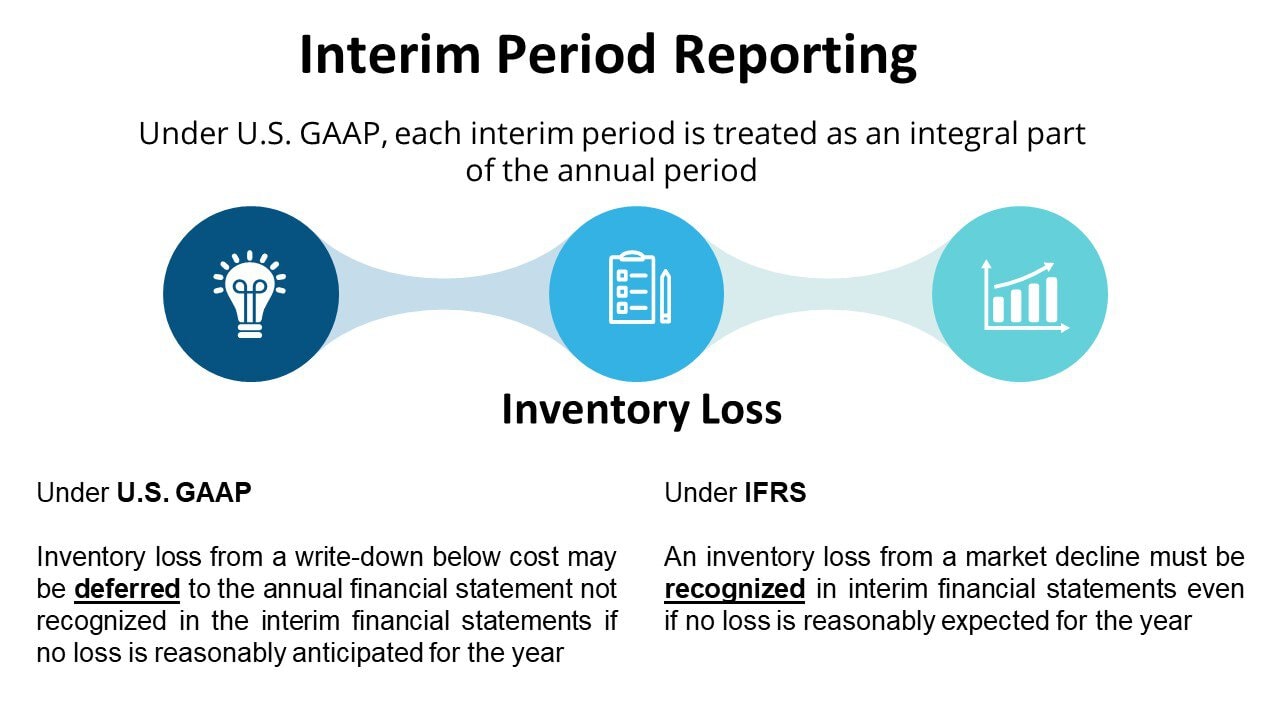

Each interim period is treated primarily as an integral part of an annual period. Ordinarily, the results for an interim period should be based on the same accounting principles the entity uses in annual statements, but certain principles may require modification at interim dates.

Inventory Measurement at Interim Dates

A Write down of inventory below cost (to market for LIFO and NRV for all other methods) may be deferred in the interim financial statements if no loss is reasonably anticipated for the year

But the inventory loss from nontemporary decline below cost must be recognized at an interim date

If the loss is recovered in another quarter, it is recognized as a gain and treated as a change in estimate. The amount recovered is limited to the losses previously recognized

Under IFRS, each interim period is viewed as a discrete reporting period. For an interim period, an inventory loss from a write-down to NRV must be recognized even if no loss is reasonably expected for the year.

If you have found this blog to be useful, you may share with your friends. Thanks!