The costs capitalized when productive assets are constructed may be direct or indirect. Internally constructed assets should be capitalized at the lower of their fair value or its cost

If cost exceeds fair value, the excess is expensed immediately to avoid overstating the asset

Qualifying Asset

Qualifying Assets are assets for which interest must be capitalized. The below are qualifying assets:

- Assets produced by the entity for its own use

- Assets produced for the entity by others for which progress payments have been made

- Assets produced for sale or lease as discrete projects, such as real estate developments or ships

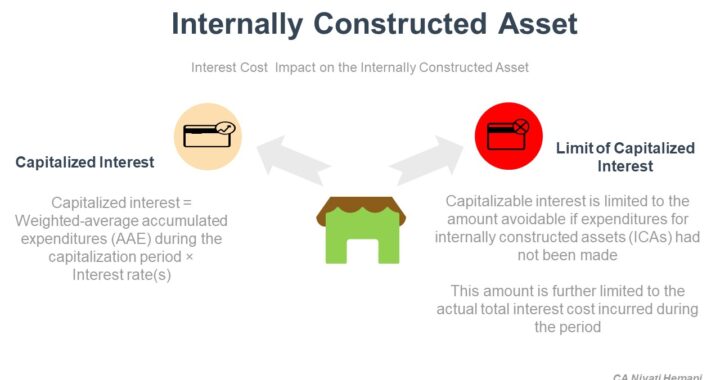

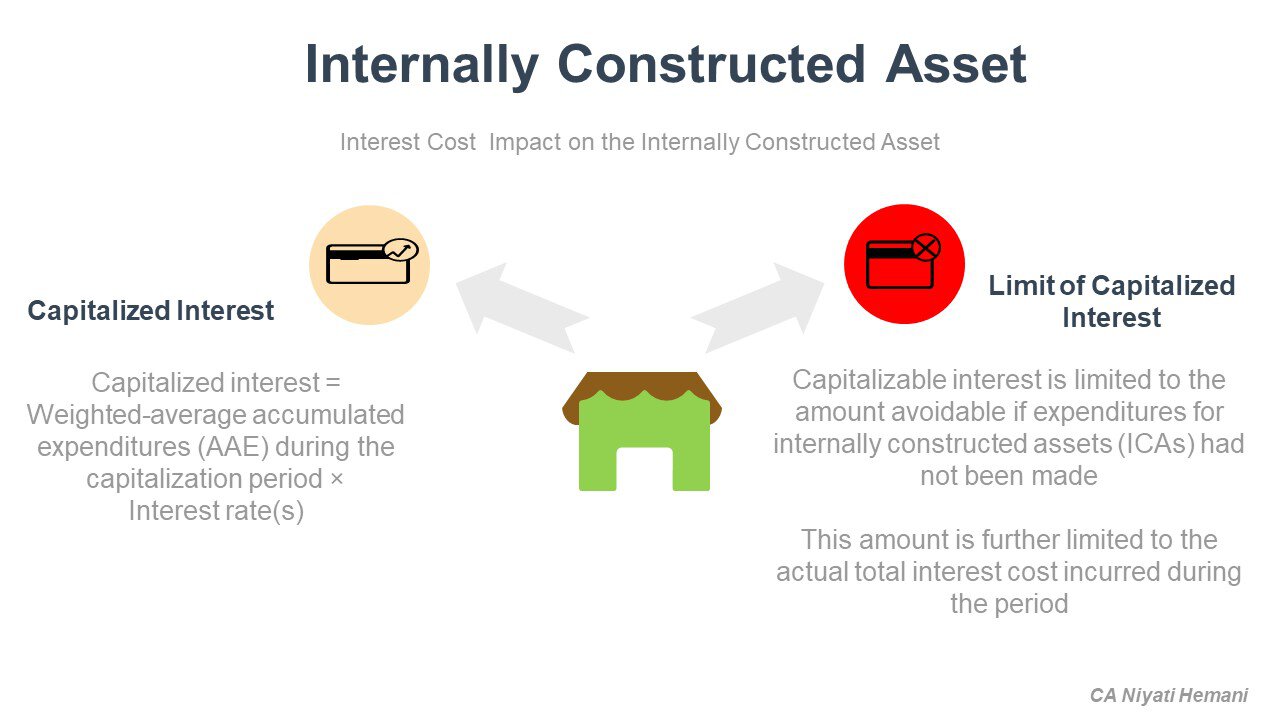

Amount of Interest cost to be capitalized

- Interest cost includes

- Interest on obligations with explicit interest rates including amortization of premium, discount, and issue costs

- Interest imputed on certain payables

- Interest on capital lease

- Interest should have been actually incurred

- Capitalized interest equals average accumulated expenditures for the qualifying asset during the period times interest rate

- Capitalized interest should NOT EXCEED the total actual interest incurred during the period

The capitalization period is the time required to carry out the activities necessary to bring a qualifying asset to the condition and location necessary for its intended use

DO NOTs:

- NOT TO capitalize interest cost on inventory routinely manufactured

- NOT TO capitalize interest during intentional delays in construction

- NOT TO capitalize interest on assets held before or after the construction period

- NOT TO reduce capitalizable interest by income received on the unexpended portion of the loan

DISCLOSURES

- If NO Interest cost is capitalized, report the amount incurred and expensed during the period

- If interest cost is capitalized, disclose the total incurred and the amount

If you have found this blog to be useful, you may share with your friends. Thanks!