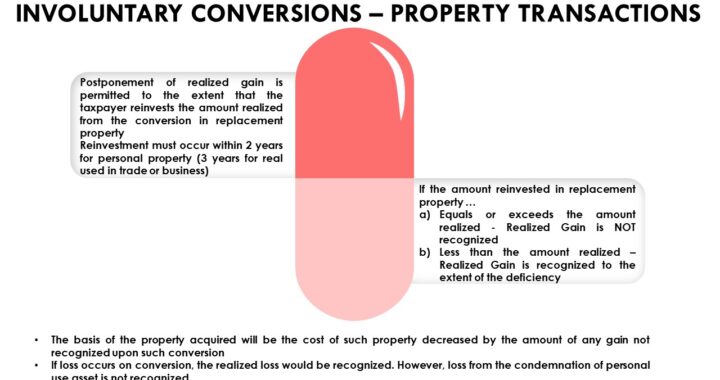

A taxpayer may elect to defer recognition of gain if property is involuntary converted into money or property that is similar or related in service or use. An involuntary conversion of property results from destruction, theft, seizure, requisition, condemnation, or threat of imminent requisition or condemnation.

When a property is converted involuntarily into nonqualified proceeds and qualified property is purchased within the replacement period, an election may be made to defer realized gain.

In an Involuntary Conversion, Recognized Gain = Lesser of the gain realized or reimbursement not reinvested.

Deferred Gain = Realized gain − Recognized gain

Basis of Acquired Property = FMV of acquired property − Deferred gain

If you have found this blog to be useful, you may share with your friends. Thanks!