Recognition and Measurement Concepts

Recognition is the process of formally recording or incorporating an item into the financial statements of an entity as an asset, liability, equity, revenue, or expense

Fundamental recognition criteria determine whether and when items should be incorporated into the statements, either initially or as changes in existing items

For recognition in financial statements an item must meet the following four criteria:

- Definition of an element

- Measurability

- Relevance

- Reliability

Measurement must be considered together with both relevance and reliability.

- The item must have a relevant attribute measurable with sufficient reliability

- An attribute is the trait or aspect of the element to be expressed in monetary terms

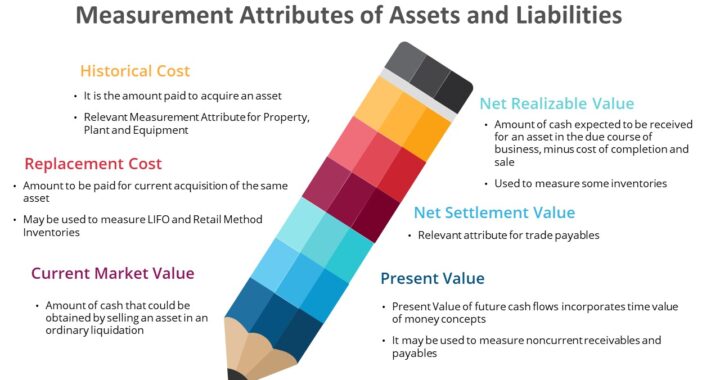

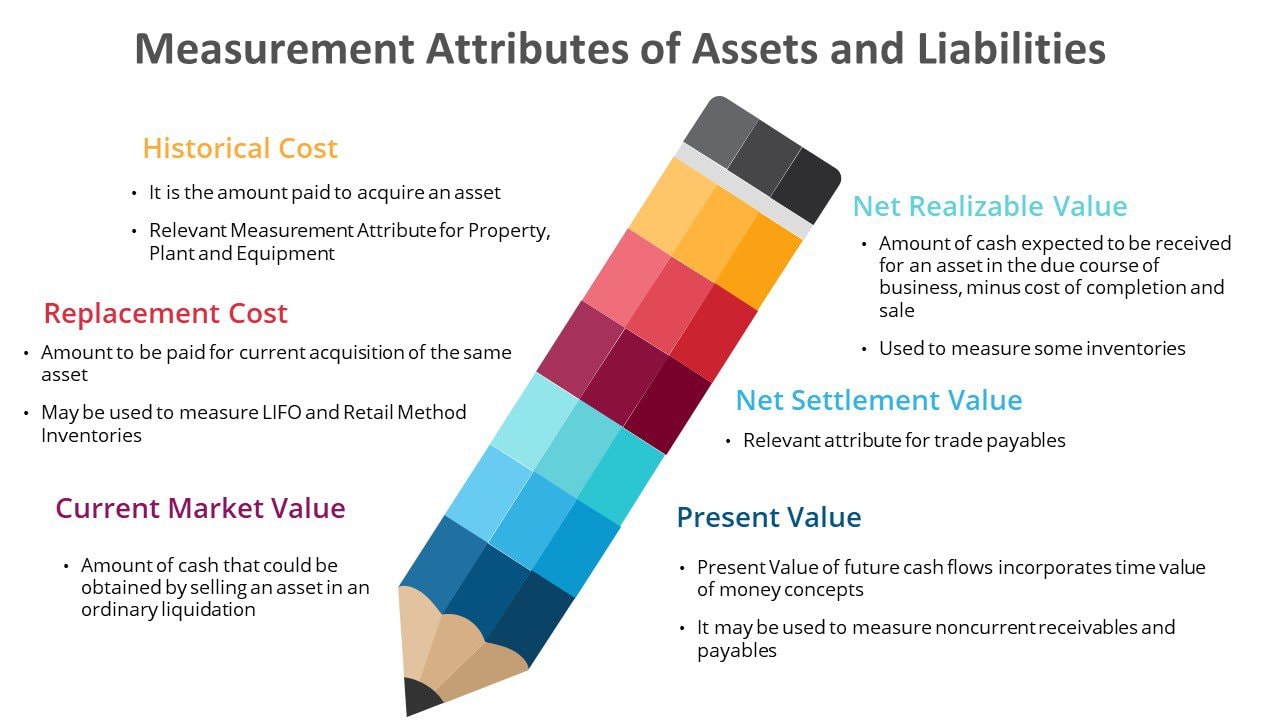

Following are the different attributes used in current practice:

- Historical Cost: Historical cost is usually acquisition cost, adjusted for depreciation and other allocations

- Property, plant, and equipment and most inventories are reported at historical cost

- Current Cost (Replacement Cost): Current cost represents the amount of cash required to purchase an equivalent asset today

- Some inventories are reported using current cost

- Current Market Value (Exit Value): Current market value represents the amount of cash that could be obtained by selling an asset in liquidation

- Trading and available for sale securities (bond and stock) are reported at current market value

- Net Realizable Value: Net realizable value is the non-discounted cash into which an asset is expected to be converted in due course of business less direct costs, if necessary, to make that conversion

- Some inventories are recorded at net realizable value

- Net Settlement Value: Net settlement value is the cash or equivalent that the entity expects to pay to satisfy an obligation in the due course of business such as trade payables and warranty obligations

- Net settlement value ignores present value considerations

- Present Value: Present value incorporates time value of money concepts. Currently used only for long-term receivables and payables

- Long term receivables and payables are reported at their discounted cash flows, that is the present value of future cash flows LESS the present value of any cash outflows to obtain the cash inflows

If you have found this blog to be useful, you may share with your friends. Thanks!