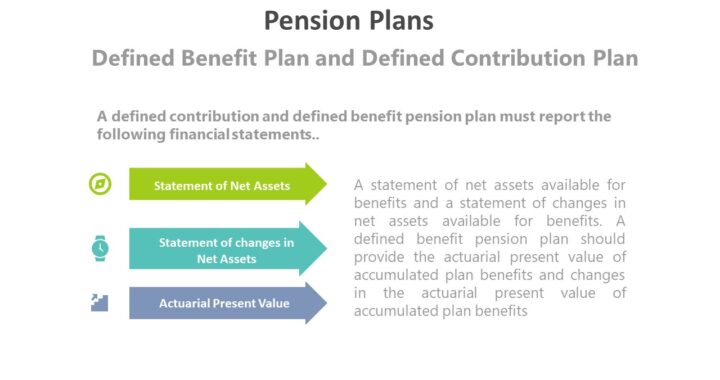

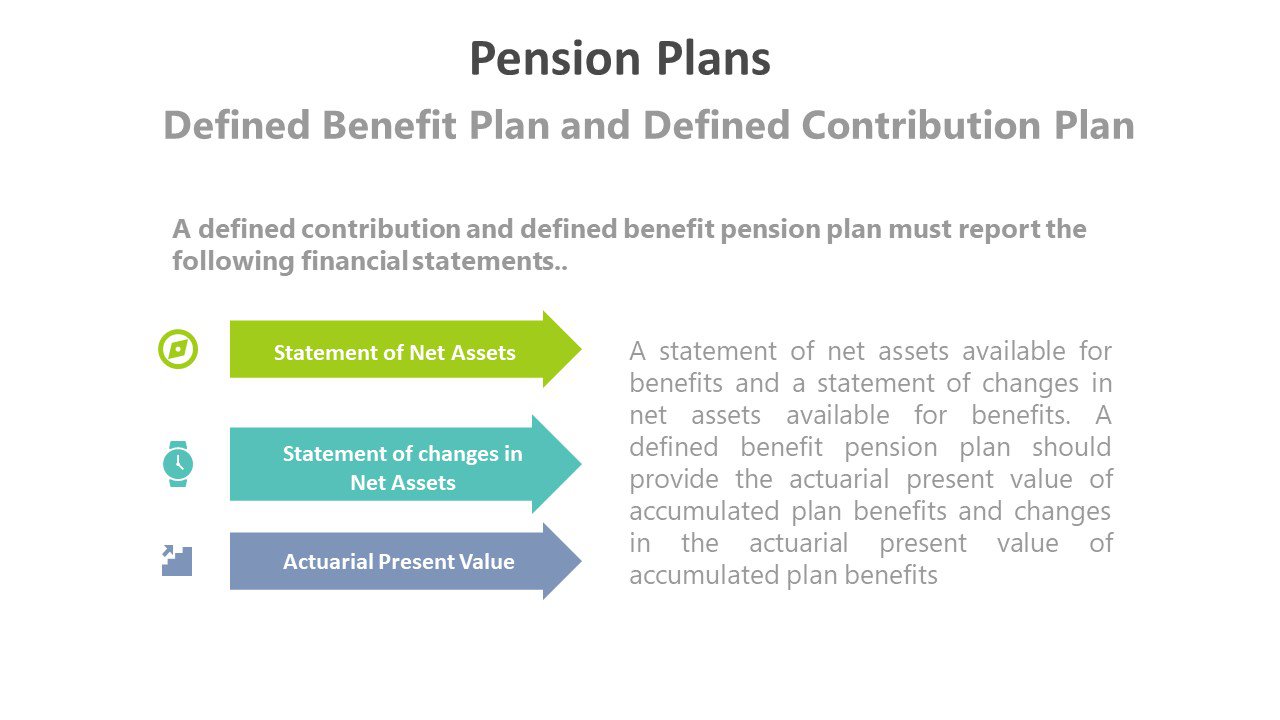

Pension Plans

A pension plan is a separate accounting entity to which a sponsoring employer makes contributions in order to provide employees retirement benefits in exchange for current or past services

Pension benefits are a form of deferred compensation and hence, they are not paid currently. They are paid to retired employees, on a periodic basis

Pension plans invests in the assets and make payments to beneficiaries. Hence, Pension Trust Funds are a separate accounting entity with its own set of books. However, the assets and liabilities belong to the employer

GAAP provides guidance for:

- Pension plan expense shown on the income statement, and

- Presentation of the related pension liability or asset on the balance sheet of the sponsor company

It is not concerned with amounts to be funded (paid) to the pension trust during the year. It is concerned with the amounts accrued and expensed by the employer company

The two types of pension plans are:

- Defined Benefit Plan (Pension Plans), and

- Defined Contribution Plan (401k Plans)

The primary objective of pension plans financial statements is to provide financial information that is useful in assessing the plan’s present and future ability to pay benefits when they are due.

Pension plans must report the following financial statements:

- A statement of net assets available for benefit in which plan investment are reported at their fair value at the reporting date

- A statement of changes in net assets available for benefits of the plan for the year then ended

A defined benefit pension plan should provide the actuarial present value of accumulated plan benefits and changes in the actuarial present value of the accumulated plan benefits

If you have found this blog to be useful, you may share with your friends. Thanks!