For each performance obligation satisfied over time, an entity must recognize revenue over time

For this purpose, the entity measures the progress toward complete satisfaction using:

- Output method; or

- Input method

To determine the appropriate method, an entity must consider the nature of the good or service that it promised to transfer to the customer

At the end of the reporting period, the progress toward complete satisfaction of the performance obligation must be re-measured and updated for any changes in the outcome of the performance obligation. Such changes must be accounted for prospectively as a change in accounting estimate.

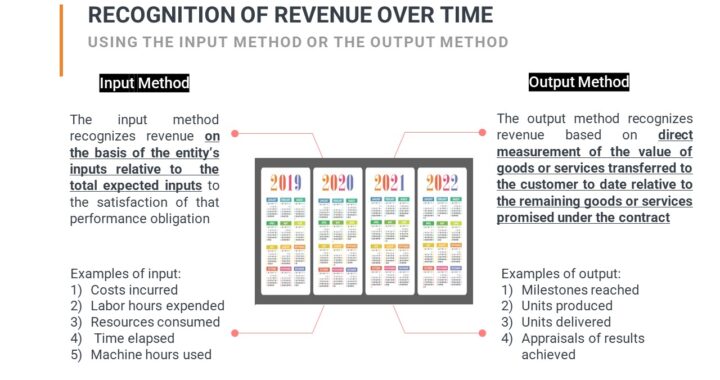

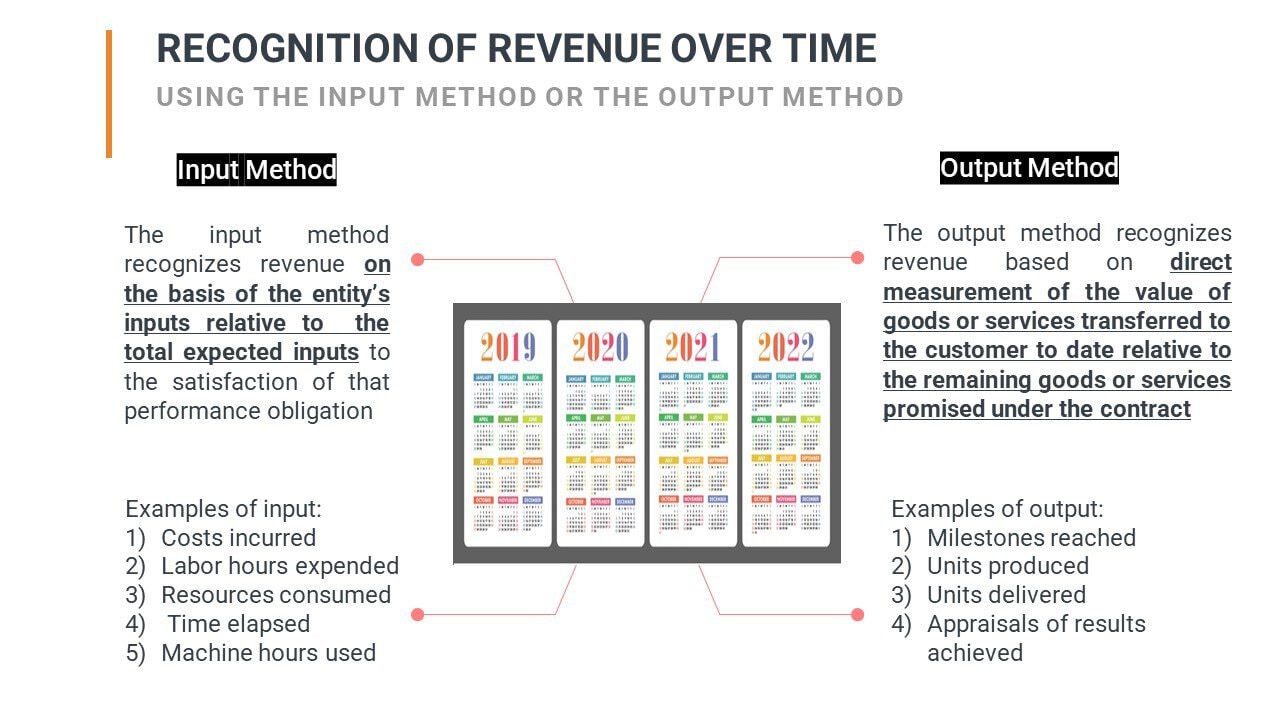

Input Method

The input method recognizes revenue on the basis of the entity’s inputs to the satisfaction of the performance obligation relative to the total expected inputs to the satisfaction of that performance obligation.

In long-term construction contracts, costs incurred relative to total estimated costs often are used to measure the progress toward completion. This method is the cost-to-cost method

Only costs that contribute to progress in satisfying the performance obligation are used in the cost-to-cost method

The following costs must not be included in measuring the progress:

- Costs incurred that relate to significant inefficiencies in the entity’s performance

- General and administrative costs not directly related to the contract

- Selling and marketing costs

Output Method

The output method recognizes revenue based on the direct measurement of the value of goods or services transferred to the customer to date relative to the remaining goods or services promised under the contract

An entity recognizes revenue for a performance obligation satisfied over time only if progress toward complete satisfaction of the performance obligation can be reasonably measured

If you have found this blog to be useful, you may share with your friends. Thanks!