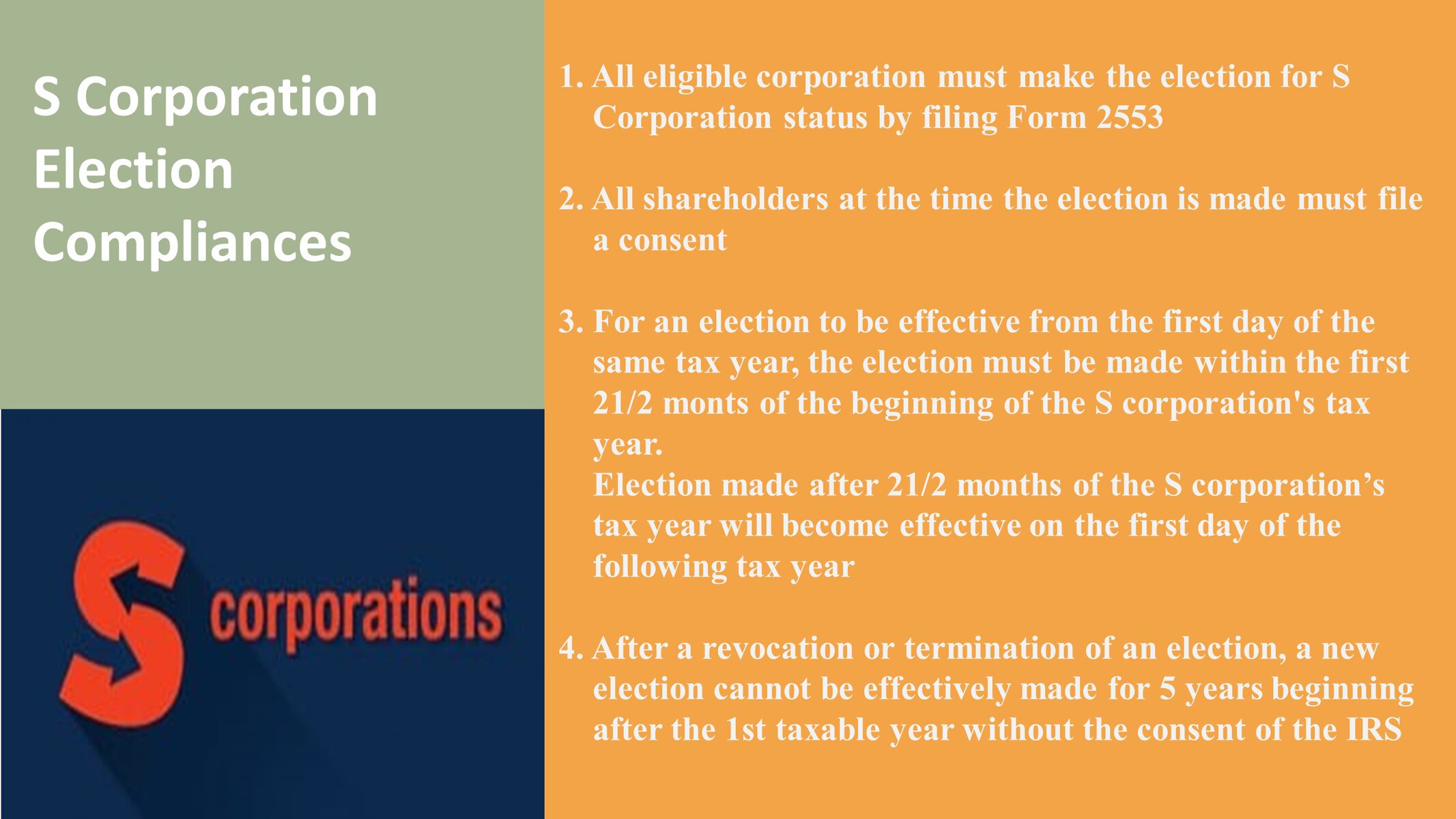

| ELECTION |

| All eligible corporation must make the election for S Corporation status by filing Form 2553 |

| All shareholders at the time the election is made must file a consent |

| Each person who was a shareholder at any time during the part of the tax year before the election is made must also consent. If any former shareholder do not consent, the election is considered made for the following year |

| For an election to be effective from the first day of the same tax year, the election must be made within the first 2 1/2 months of the beginning of the corporation’s tax year. Election made after 2 1/2 months of the corporation’s tax year will become effective on the first day of the following tax year |

| IRS can treat a late filed election as timely filed if it determines that reasonable cause existed for failing to file the election in a timely manner |

| After a revocation or termination of an election, a new election cannot be effectively made for 5 years beginning after the 1st taxable year without the consent of the IRS [Eg. Revocation of S Corp Status on 31 Dec 2020, reelect S Corp Status without IRS consent on 1 January 2026] |

| TERMINATION |

| An S corporation election is terminated by any of the following: Consent from a majority of shareholders (voting and nonvoting) – 50% or more of total shareholders – MCQ Any eligibility requirement not being satisfied on any day E.g., accepting a disallowed entity as a shareholder, exceeding 100 shareholders, etc. For 3 consecutive years, the corporation has both Subchapter C E&P and passive investment income greater than 25% of gross receiptsUpon Termination event, S Corporation becomes a C Corporation If you have found this blog to be useful, you may share with your friends. Thanks! |