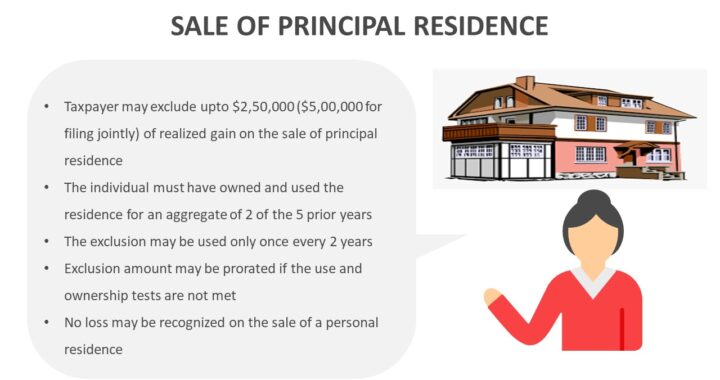

Section 121 provided an exclusion upon the sale of a principal residence. No loss may be recognized on the sale of a principal residence.

Two tests to qualify for exclusion of gain upon principal residence are:

- Ownership test – Taxpayer has owned the residence for 2 of the 5 prior years

- Use test – Taxpayer has used the residence for 2 of the 5 prior years

Section 121 allows an exclusion of up to $250,000 for single taxpayers on the sale of a principal residence they have owned and lived in for 2 of the last 5 years. An exclusion of up to $500,000 is allowed for married taxpayers filing jointly on the sale of a principal residence.

The proration applies when

(1) The ownership test and the use test are not met, but the sale is due to a change in place of employment, health, or unforeseen circumstances, or (2) The residence sold was not used as the principal residence of the taxpayer for part of the prior 5 years.