Self Employed Business Income and Expenses

Self Employment Income is generally reported by Sole proprietors and Independent contractors

The three requirements for an expense from a trade or business to be deductible from self-employment income are Ordinary, Necessary, and Reasonable

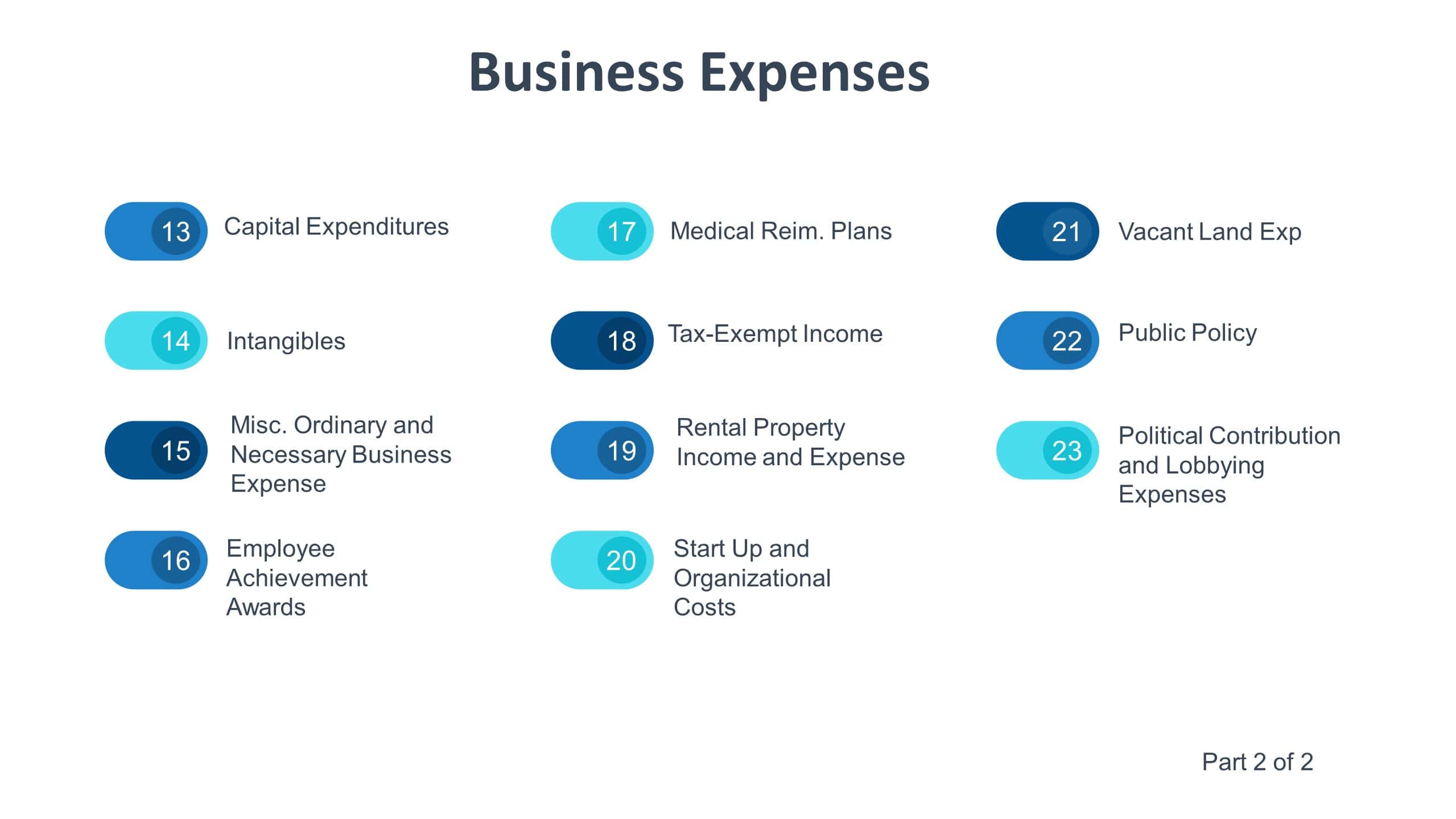

Business Expenses may include:

- Rent

- Business Meals

- Travel

- Foreign Travel

- Entertainment

- Automobile Expenses

- Taxes

- Insurance Expense

- Bad Debts

- Loan Costs

- Business Gifts

- Employee Achievement Awards

- Start-Up and Organizational Costs

- Vacant Land

- Medical Reimbursement Plans

If you have found this blog to be useful, you may share with your friends. Thanks!