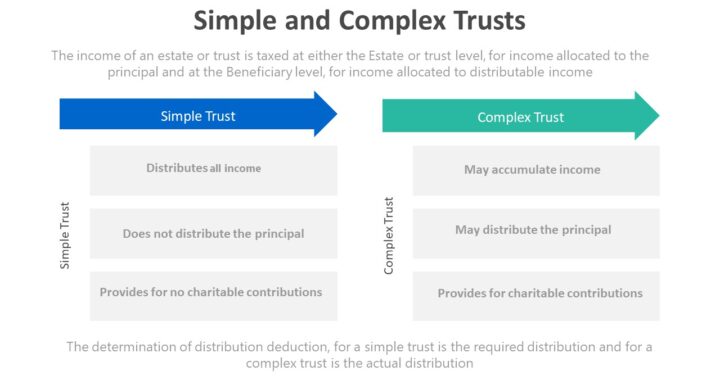

Simple Trust – A simple trust is formed under an instrument that (1) requires current distribution of all its income, (2) requires no distribution of the res (i.e., principal, corpus), and (3) provides for no charitable contributions by the trust.

Complex Trust – A Complex Trust is a Trust that permits accumulation of current income, provides for charitable contributions, or distributes principal during the taxable year.

Grantor Trust – A grantor trust is any trust to the extent the grantor is the effective beneficiary. Incomes from grantor trusts are taxed to the grantor (not the trust).

A grantor type trust is a legal trust under applicable state law that is not recognized as a separate taxable entity for income tax purposes because the grantor or other substantial owners have not relinquished complete dominion and control over the trust.

Simple Grantor Trust – A simple trust requires current distribution of all its income, requires no distribution of the res (i.e., principal, corpus), and provides for no charitable contributions by the trust. A grantor trust is any trust to the extent the grantor is the effective beneficiary

If you have found this blog to be useful, you may share with your friends. Thanks! If you have found this blog to be useful, you may share with your friends. Thanks!