Accounting for the costs of developing or obtaining computer software depends on whether the software is (1) sold to external customers or (2) used internally

Costs of software may be

a) Expensed as incurred

b) Capitalized as computer software costs, or

c) Included in the inventory

Costs of software to be used internally are either expensed or capitalized

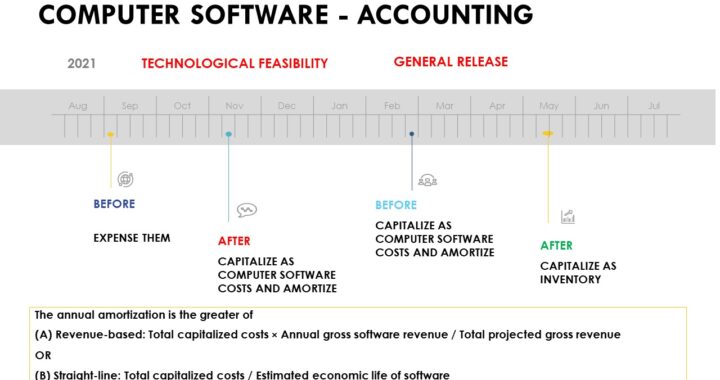

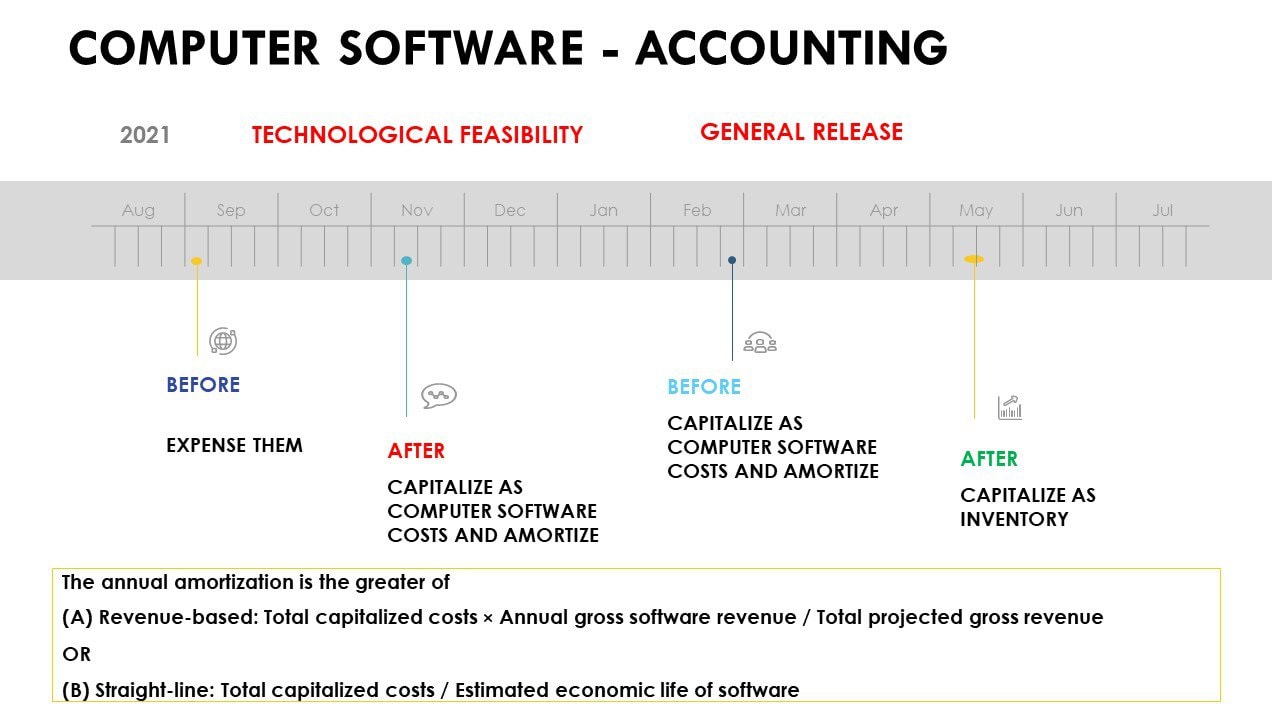

Software to be Marketed

Cost Expensed

Accounting for the costs of computer software to establish technological feasibility should be expensed when incurred. Technological feasibility is established when either a detailed program design is complete or the entity has created a working model

Costs Capitalized

- Costs incurred after technological feasibility is established are capitalized as computer software costs

- Amortization begins and capitalization ends when the product is available for general release

- If purchased software to be marketed has no alternative future use, the entity accounts for its cost as if it had been developed internally to be marketed. If purchased software to be marketed has an alternative future use, the entity capitalizes the cost when it purchases the software and accounts for it according to use

Cost Included in Inventory

Costs incurred to prepare the product for sale (duplication of software, training materials, packaging) are capitalized as inventory

Annual Amortization of Capitalised Software Costs

Annual amortization is the greater of

a) Total capitalized costs times the revenue ratio (Annual gross software revenue / Total projected gross revenue) or

b) Straight-line amortization (Total capitalized cost / Estimated economic life of the software)

Balance Sheet Measurement

- Capitalized software costs are measured at the lower of unamortized cost or net realizable value

- A loss on the write down to NRV is recognised in the income statement. After the write-down, the carrying amount of computer software is the new cost basis

Software to be used Internally

Costs Expensed

Costs incurred during the preliminary project stage and for training and maintenance are expensed as incurred

Costs Capitalized

Costs incurred during the application development stage (coding, testing) are capitalized as computer software costs

When software is replaced, unamortized costs of the old software are expensed

Annual Amortization

Annual amortization of the capitalized costs of software to be used internally is on a straight-line basis over the estimated economic life of the software

Subsequent Sale

When software developed for internal use is sold to outside parties,

- The net proceeds from these sales reduce the carrying amount of capitlized software costs

- When the carrying amount is $0, net proceeds are recognized as revenue