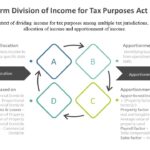

Before a state can tax a non resident, a minimum presence in the taxing state by the non resident must be established. In the context of Uniform Division of Income for Tax Purposes, income is distributed among multiple tax jurisdictions by allocation of income and apportionment of income. In the context of dividing income for […]

Continue reading