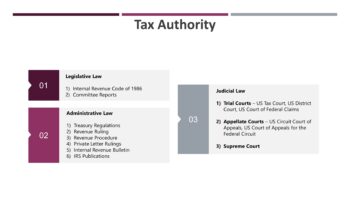

3 Sources of Authoritative Federal Tax Law are:

Legislative law

Administrative law

Judicial law

Legislative Law

Legislative law, which comes from Congress is authorized by the constitution and consists of the Internal Revenue Code and Committee Reports.

The Internal Revenue Code of 1986 is the primary source of Federal Tax Law. It imposes income, estate, gift, employment, and miscellaneous excise taxes and provisions controlling the administration of federal taxation. It is the most authoritative source of tax law.

Administrative Law

Administrative law implemented and enforced by the Treasury Department includes

Treasury regulations

Revenue rulings

Revenue procedures

Private Letter rulings (PLRs)

Internal Revenue Bulletins (IRBs)

IRS Publications

Judicial Law

The Tax Court, the U.S. District Court, and the U.S. Court of Federal Claims courts are referred to as courts of original jurisdiction, or trial courts, for tax matters. There are three levels of federal courts that hear tax cases. They are trial courts, appellate courts, and high court.