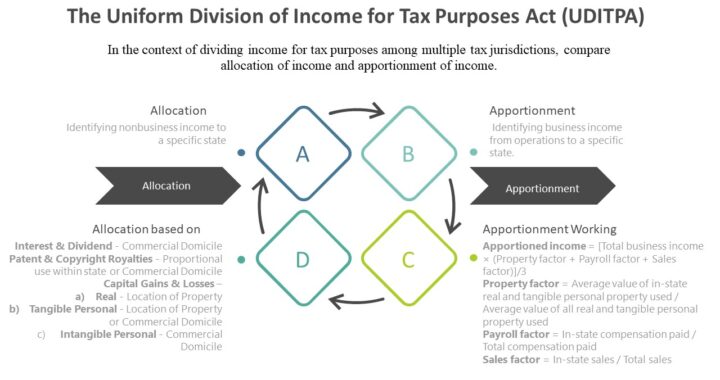

Before a state can tax a non resident, a minimum presence in the taxing state by the non resident must be established. In the context of Uniform Division of Income for Tax Purposes, income is distributed among multiple tax jurisdictions by allocation of income and apportionment of income.

| In the context of dividing income for tax purposes among multiple tax jurisdictions, compare (1) allocation of income and (2) apportionment of income. |

| Allocation Identifying nonbusiness income to a specific state Apportionment Identifying business income from operations to a specific state |

| The term “allocation” is used in tax discussions to identify investment income from assets held solely for investment purposes by foreign entities, and “apportionment” is the term used to describe formulas used to calculate what portion of a firm’s total world-wide earnings is from operations within a particular state. |

| All business income is apportioned to a taxing state by multiplying the business income by the sum of the property, payroll, and sales factors divided by three. |

| Apportioned income = [Total business income × (Property factor + Payroll factor + Sales factor)]/3 Property factor = Average value of in-state real and tangible personal property used / Average value of all real and tangible personal property used Payroll factor = In-state compensation paid / Total compensation paid Sales factor = In-state sales / Total sales |

| Non Business Income allocation based on |

| a) Interest & Dividend – Commercial Domicile |

| b) Patent & Copyright Royalties – Proportional Use within state or Commercial Domicile |

| c) Capital Gains & Losses – a) Real – Location of Property ; b)Tangible Personal – Location of Property or Commercial Domicile ; c) Intangible Personal – Commercial Domicile |

| d) Net Rents & Royalties – a) Real – Location of Property ; b)Tangible Personal – Location of Property or Commercial Domicile |