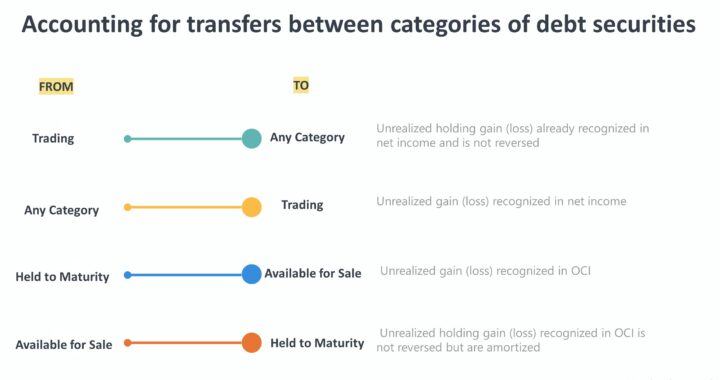

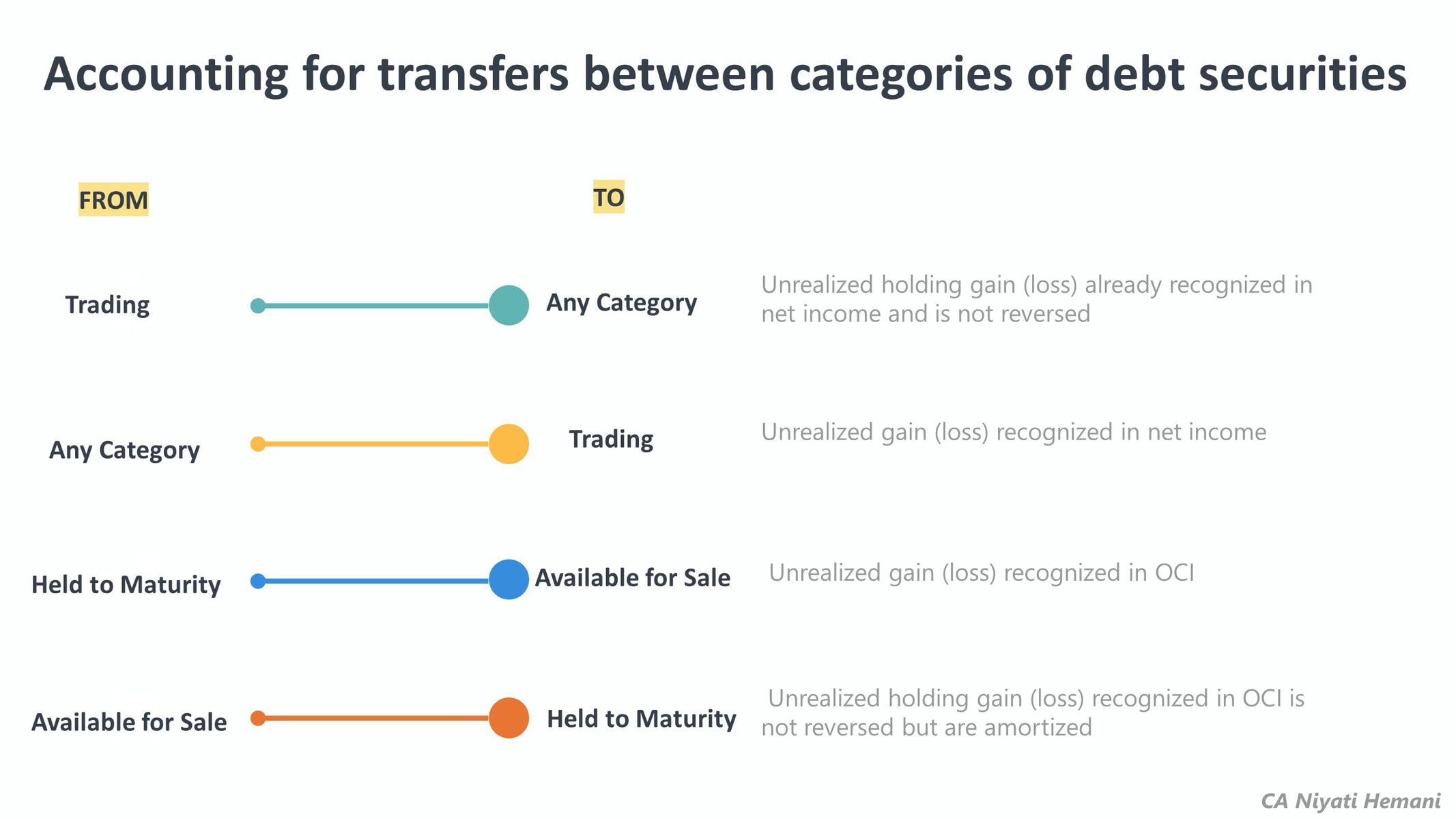

Transfer between categories of debt securities is accounted for at transfer date fair value. The following describes the treatment of unrealized holding gains and losses at that date:

From To Earnings Recognition

Trading Other Category

Unrealized holding gains and losses on securities have already been recognized in the income statement at the last reporting date and hence, are not reversed

Other Trading

Unrealized holding gains and losses on securities (not previously recognized in income) must be recognized in earnings immediately

HTM AFS

Unrealized holding gains and losses on securities must be recognized in Other Comprehensive Income

AFS HTM

Unrealized holding gains and losses on securities must continue to be reported in Other Comprehensive Income

If you have found this blog to be useful, you may share with your friends. Thanks!