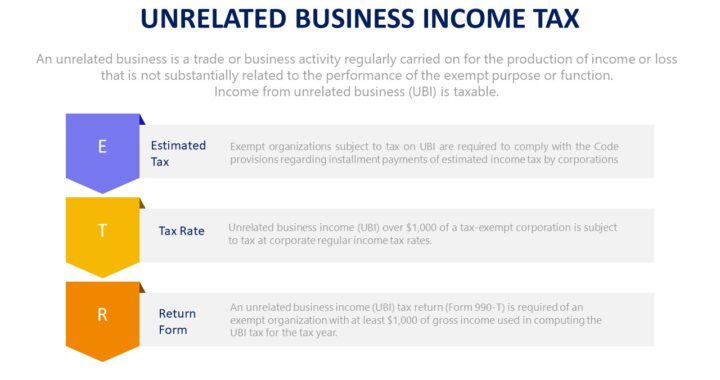

| UNRELATED BUSINESS INCOME TAX |

|

| Unrelated business income (UBI) is income from a trade or business, regularly carried on, that is not substantially related to the charitable, educational, or other purpose constituting the basis for an organization’s tax-exempt status. But income is not subject to tax as UBI if substantially all the work is performed for the organization by unpaid volunteers. |

| Exempt organizations subject to tax on UBI are required to comply with the Code provisions regarding installment payments of estimated income tax by corporations [Sec. 6655(g)(3)]. |

| Eg. Income derived from bingo games is not treated as unrelated business income if the games are conducted in a state in which bingo games are ordinarily not carried out or conducted on a commercial basis and if the games are not illegal under the state’s or locality’s law. |

| Eg. The sale of the educational materials by the trade association for seminars oriented toward its members is most likely an activity that is substantially related to the performance of the exempt purpose of the trade association. |

| Unrelated business income (UBI) over $1,000 of a tax-exempt corporation is subject to tax at corporate regular income tax rates. |

| An unrelated business income (UBI) tax return (Form 990-T) is required of an exempt organization with at least $1,000 of gross income used in computing the UBI tax for the tax year. |

|

|

|

If you have found this blog to be useful, you may share with your friends. Thanks! |

|

|

|