A warranty is a written agreement of the integrity of a product or service and an undertaking by the seller to:

- Repair or replace a product

- Refund all or part of the price, or

- Provide additional service

A warranty is customarily offered for a limited time, such as 2 years. It may or may not be sold separately from the product or service

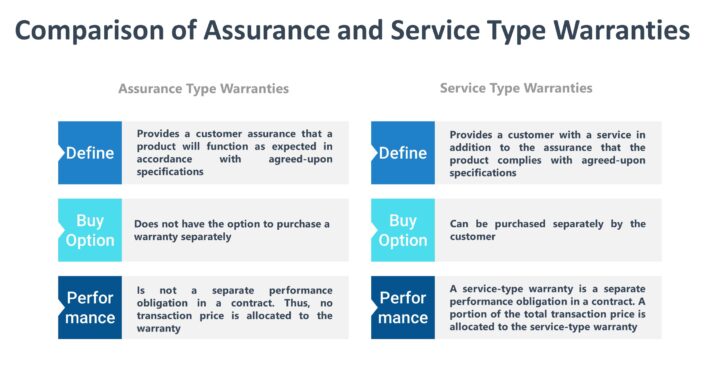

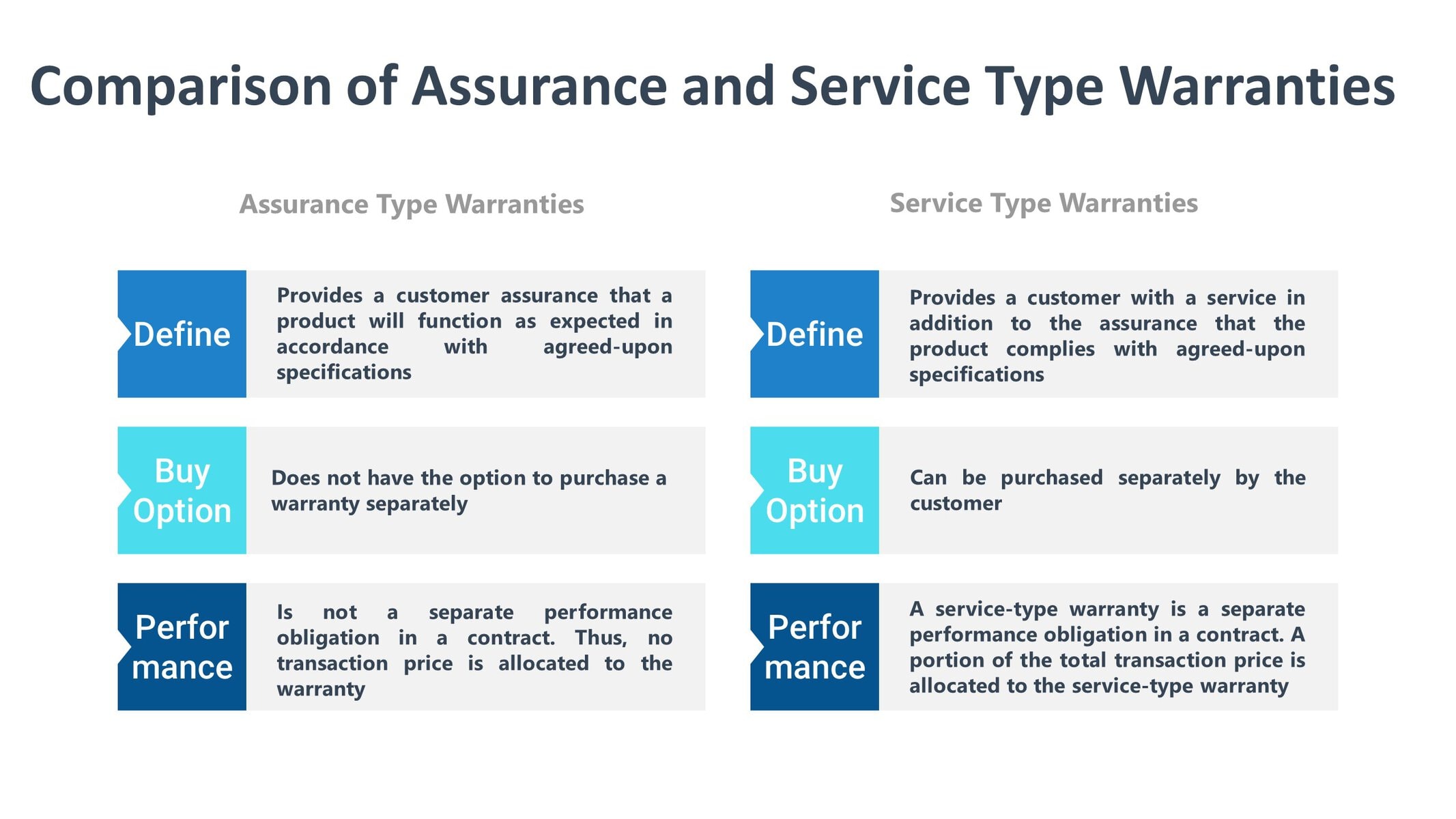

Types of Warranties

Assurance-type Warranty

A warranty that provides a customer assurance that a product will function as expected in accordance with agreed-upon specifications

A warranty required by law is an assurance-type warranty

Service-type Warranty

A warranty that provides a customer with a service in addition to the assurance that the product complies with agreed-upon specifications

A warranty that can be purchased separately by the customer is a service-type warranty. It is accounted for as a separate performance obligation in the contract. If the customer does not have the option to purchase the warranty separately, the warranty is an assurance-type warranty

If an assurance-type and service-type warranty provided in the contract cannot be separated, the warranties are accounted for as a single performance obligation in a contract, i.e. as a service-type warranty

Accounting for an Assurance-Type Warranty

An assurance-type warranty is not a separate performance obligation in a contract. Hence, no transaction price is allocated to the warranty

An assurance-type warranty creates a loss contingency, if:

- The incurrence of warranty expense is probable

- The amount can be reasonably estimated, and

- The amount is material

A liability for warranty cost is recognized when the related revenue is recognized i.e. on the day the product is sold

Even if the warranty covers a period longer than the period in which the product is sold, the entire liability (expense) for the expected warranty costs must be recognized on the day the product is sold

Actual payments made for warranty costs reduce the amount of warranty liability recognized and do not affect the warranty expense. If the warranty payments in the later period(s) are greater than the amount of warranty liability recognized, the excess is recognized as warranty expense

Accounting for Service-type Warranty

A service-type warranty is a separate performance obligation in a contract. Hence, a portion of the total transaction price is allocated to the service-type warranty

The total transaction price is allocated to the service-type warranty and the related product sold based on their estimated standalone selling prices

At contract inception, the consideration received for the service-type warranty is accounted for as an advance payment and a contract liability is recognized.

Revenue from a service-type warranty is recognized over time

The pattern of revenue recognized depends on the way the warranty performance obligation is satisfied

-

- If warranty service is provided continuously over the warranty period, revenue is recognized on a straight-line basis over the coverage period

- If warranty service costs are not incurred on a straight-line basis, revenue recognition over the contract's term should be proportionate to the estimated service costs

If you have found the blog to be useful, you may share with your friends. Thanks!