Wealth management and investment are two pillars for anyone looking for harmony of wealth and financial growth. Wealth management is a comprehensive approach to financial planning that takes into account your individual goals and circumstances along with the strategies used to protect, grow and transfer your wealth. Investment is a means of achieving the goals of wealth management and is often a key component in creating a secure and prosperous financial future.

When it comes to wealth management and investments, it is important to balance, protect, plan and invest. Here are some helpful tips to consider:

Balance – One needs to achieve balance between income vs. expenses, needs vs. wants, risks vs. rewards and debts vs. investing. It is important to have a good understanding of your monthly cash flow to determine if it is positive or negative. If it is negative, one must take the necessary steps to address it and achieve balance. If it is positive, one must use the extra cash to propel towards financial prosperity.

Protect – Protecting one’s financial standing may involve setting up an emergency fund, protecting one’s cash flow with retirement cash wedges, and gaining appropriate life insurance, disability insurance, and critical illness insurance. It’s also important to properly protect one’s estate with a power of attorney and a will.

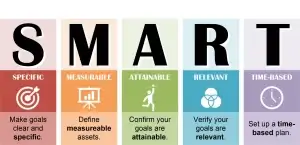

Plan – Planning is a key part of achieving financial security. One needs to set SMART goals – Specific, Measurable, Attainable, Realistic and Timely. Without a financial plan, one may suffer from lack of sleep, health issues, marriage/ relationship issues and mental health complications. Once a financial plan is developed, it is important to automate savings and have an accountability partner to help keep one on track.

Invest – Investing requires knowledge and research of the products available and understanding of factors such as time and inflation. Investment opportunities involve cash equivalents, fixed income instruments, stocks, equities, real estate, private equity and specialty investments like cryptocurrency. It’s important to diversify investments to ensure maximum protection and growth for one’s financial future.

By taking the time to balance, protect, plan and invest, one will be one step closer to achieving their long-term financial goals and gaining harmony of wealth.

Investing

Investing is an essential part of financial planning and can help you achieve your long-term goals. When considering how to best invest your money, it is important to understand the various investment options available and the associated risks, rewards, and costs.

The first step when investing is to match your goals to the right product. This entails understanding the impact of time and inflation, and assessing the risk versus reward, taxes, and expected income associated with each product. Next, determine how much you need to invest each year to reach your financial goals. The Rule of 72 can help you understand how long it will take to double your investment, considering the current interest rate. When assessing the impact of inflation, consider the consumer price index, as it helps measure the income required to maintain purchasing power at the inflation rate.

Investmments and asset allocation concept. Where to Invest? Newspaper and direction sign with investment options. 3d illustration

Four Basic Asset Classes

The four basic asset classes to consider when investing are

- Cash equivalents

- Fixed income

- Equities

- Alternative investments.

Cash equivalents allow you to cope with unplanned events or emergencies, and offer flexibility when taking advantage of opportunities. Cash equivalent investments can include money market funds, savings accounts, treasury bills, and an established line of credit.

Fixed income is the type of debt that you are owed in the future, and provides a steady stream of interest income. When investing in fixed income, pay attention to the rate of interest, credit rating, duration, and tax implications.

Equities, also known as stocks, are shares of ownership in a company. Money can be made from equity investments through capital appreciation and dividends. Investing in stocks requires an understanding of the company’s market cap, P/E ratio, geographic allocation, sector allocation, currency allocation, competition, management, sales growth, earnings growth and forecasts, price to book value, and tax implications.

Real estate investments include residential, single and multi-family, apartment, commercial, industrial, and retail. Additionally, Real Estate Investment Trusts (REITs), which are companies that own, operate, and finance real estate portfolios, may also be considered.

Private equity is a form of venture capital that invests in assets such as companies, real estate, or other assets. It typically occurs in the early, mid, and late stages of a start-up, when the private company is seen to have long-term potential.

Commodities and specialty investments involve commodities such as gold, oil, grains, coffee, etc. There are three primary ways to invest in commodities: direct physical investment, commodity futures, or commodity-related futures.

Finally, cryptocurrency is a form of digital or virtual currency secured by cryptography. Cryptocurrency is largely decentralized and can provide faster and cheaper money transfers as well as tax benefits.

To protect yourself against ignorance and minimize risk, it is advised to diversify investments across different asset classes. Cost of investing and advice should also be taken into account. Investing can be an important factor when constructing your financial plan, but it is important to understand the available options and associated risks and rewards. Lastly, before investing it is important to do your research. Research the different investments that you are considering, and talk to a financial adviser or tax adviser to ensure that your investments are suitable for your needs. With research, discipline and patience, you can set yourself up for a successful financial future.