Working Capital

Working capital is Current Assets reduced by Current Liabilities

Permanent Working Capital is the level of liquid assets that must be maintained regardless of the firm's level of activity or profitability. As the firm’s needs change on a seasonal basis, temporary working capital is increased or decreased.

Working Capital Financing

Spontaneous financing is the amount of current liabilities that arise naturally in the ordinary course of business.

Trade credit is created when a firm is offered credit terms by its suppliers.

A firm ideally should offset each element of its temporary working capital with a short-term liability of the same maturity. The ideal practice is maturity matching or hedging.

A firm that adopts a conservative financing policy seeks to minimize liquidity risk by financing its temporary working capital mostly with long-term debt. Conservative policies take advantage of the certainty inherent in long-term debt.

However, working capital is idle during periods when it is not needed, and this inefficiency is mitigated by investing in short-term securities. Additionally, long-term debt is more expensive.

An aggressive financing policy involves reducing liquidity and accepting a higher risk of short-term cash flows shortages by financing part of the firm’s permanent working capital with short-term debt.

However, aggressive policies are subject to unexpectedly high-interest rates or the unavailability of financing in the short term.

Liquidity Ratios

Liquidity is a firm’s ability to pay its current obligations as they come due and thus remain in business in the short run.

Liquidity ratios include the following:

- Net Working Capital = Current assets – Current liabilities

- Current ratio = Current assets / current liabilities

- Quick (acid-test) ratio =

(Cash and equivalents + Short-term marketable securities + Net receivables) / Current liabilities

- Operating cash flow ratio = Cash flow from operations / current liabilities

Receivables Management

The goal of receivables management is to offer the terms of credit that will maximize profits, not sales.

The most popular credit term is 2/10, net 30.

Factoring is an arrangement in which an entity sells its accounts receivable at a discount to another entity, called a factor, that usually specializes in collections.

The period of time from when a payor puts a check in the mail to the availability of the funds in the payee’s bank is called a float. Firms attempt to decrease float for receipts and increase floats for payment.

Key formulas are:

Accounts receivable turnover ratio = Net credit sales / Average balance in accounts receivable (net)

Average collection period = Ending accounts receivable (net) / (Net credit sales/days in year)

= Days in a year / Accounts receivable turnover ratio

Need to talk to debtors for negotiating the terms of credit, and other short-term financing options

Minimizing the total cost of inventory involves a constant re-evaluation of the trade-offs among the four components of the total:

Purchase costs + Carrying costs + Ordering costs + Stockout costs

Lead time is the time between placing an order and the receipt of goods from the supplier

Safety stock is an inventory buffer held as a hedge against contingencies

The reorder point is the inventory amount indicating a new order should be placed

Reorder point = (Average daily demand * Lead time in days) * Safety stock

The Economic Order Quantity (EOQ) model determines the order quantity that minimizes the sum of ordering cost and carrying costs.

EOQ = square root (2OD / c)

O = ordering cost per purchase order

D = periodic demand in units/usage of units

C = periodic carrying costs per unit

The assumptions underlying the EOQ model are (1) demand is uniform (2) order (setup) costs and carrying costs are constant, and (3) no quantity discounts are allowed

The purpose of the Just-In-Time (JIT) inventory system is to minimize the cost associated with inventory control. Agreements with suppliers ensure that materials arrive exactly when needed. Is it a pull system

Materials requirement planning (MRP) is a computer-intensive system for moving materials through a production process according to a predetermined schedule that is driven by forecasted demand. There are 3 essential elements:

- Master production schedule

- Bills of Materials, and

- Perpetual Inventory records

Manufacturing resource planning (MRP II) does not replace an MRP system, it simply extends scope. Both MRP and MRP II are push systems.

Need to analyze the inventory management method and its implications

Inventory Management – Ratios

Inventory turnover and days’ sales in inventory are ratios that measure the efficiency of inventory management.

Inventory turnover = COGS / Average balance in inventory

High turnover implies that the firm is not carrying excess inventory o that the inventory is not obsolete.

Days Sales in Inventory = Ending Inventory / (COGS/days in a year)

It signifies the age of the firm’s inventory. The older it is the higher, the risk of obsolescence.

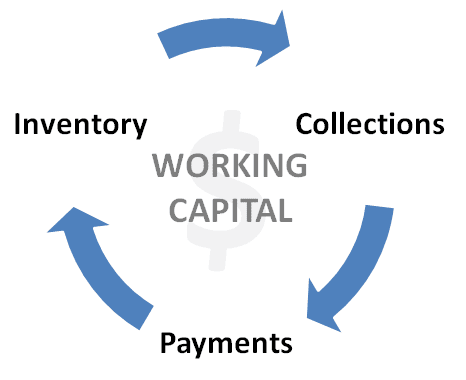

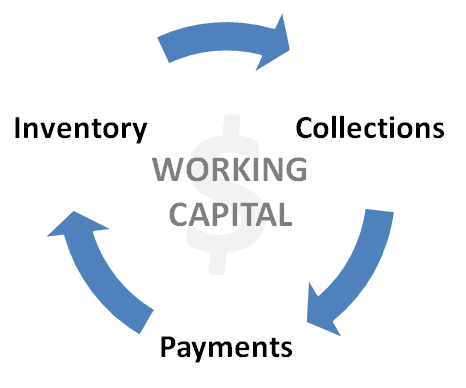

Operating Cycle and Cash Conversion Cycle

The firm’s operating cycle is the amount of time that passes between the acquisition of inventory and the collection of cash on the sale of that inventory. The longer the operating cycle, the greater the need for liquidity.

Operating cycle = Days’ sales in receivables + Days’ sales in inventory

The cash conversion cycle is the amount of time that passes between the payment of cash for inventory purchases and the collection of cash from the sale of that inventory.

Cash Conversion Cycle = Days’ sales in receivables + Days’ sales in inventory – Average payables period

Accounts Payable Turnover = Cost of goods sold / Average Balance in accounts payable

Average Payable Period = Ending accounts payable / (COGS/Days in a year)

Short-Tem Financing

- A Term loan is repaid by a definite time

- Line of Credit allows a firm to re-borrow continuously up to a maximum limit if minimum payments are made each month

- A simple interest loan is one in which the interest is paid at the end of the loan term.

The effective interest rate on the loan equals net interest expense divided by usable funds

- Discounted loans are those in which the interest is paid at the beginning of the loan term

Total borrowings of discounted loan = Amount needed / (1-Stated rate)

Effective rate on discounted loan = Stated rate / (1-Stated rate)

- Banks may require loans with compensating balances to reduce risk and increase their returns

Total borrowings = Amount needed / (1-Compensating balance %)

Effective rate = Stated rate / (1-Compensating balance%)

If you have found this blog to be useful, you may share with your friends. Thanks!